OverView

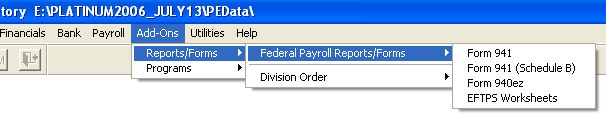

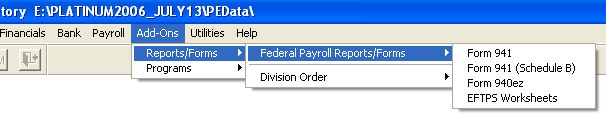

These are addiitonal Special Programs and Reports/Forms that can be purchased seperately. Contact RSI at 1-800-635-5846, to order these additional programs. For a complete list of additional programs offered by RSI, visit Roughneck Systems web site.

WHAT ARE THESE FORMS?

Form 941, Form 941 Schedule B, and Form 940 are IRS Forms used to report Payroll taxes, that must be filed with the IRS.

The 941 is a Quarterly payroll tax report. It must be completed and filed with the IRS after each quarter. The data for this form is updated when you zero the Quarter. The tax information should match the End of Quarter Payroll report.

The 941 Schedule B, is additionally required if you are a SemiWeekly depositor. The data for this form is updated when you zero the Quarter. See SetUp IRS Forms.

The 940 is a Yearly payroll tax report. It is filed with the IRS at the end of the Calendar Year. The data for this form is updated when you zero the Calendar Year values. The tax information should match the End of Year Payroll report.

The EFTPS (Electronic Federal Tax Payment System) is a special report containing all the data required to make your Payroll deposit via the Internet or Phone. This report is printed during each update of the payroll. To make your payment to the IRS over the internet, go to http://www.eftps.gov. You will need to register with the IRS and receive a password from them for your company. To make payments via the phone, use the phone number listed on the report.

PRELIMINARY REPORTS

At anytime, you can print a 941 or 941Schedule B, for the current quarter and it should match the Preliminary payroll end of quarter report. Likewise, the current year 940 form should match the Preliminary payroll end of year report.

REQUIREMENTS = ADOBE READER

The IRS uses Adobe Reader for interfacing to these forms. This is the standard IRS format for these forms. You must have Adobe Reader version 5 or higher installed on your computer. It can be found on the web here Get Adobe Reader - (www.adobe.com). Click on the button for Adobe Reader, you do NOT need the Adobe Flash Player.

MODIFYING THE FORMS

You can modify the "values" for each form using the Adobe Reader. If you install the programs during the middle of a quarter, not all payroll amounts for each payroll will have been captured for 941 Schedule B. Therefore, the first time, you will need to physically plug-in the missing data into Schedule B using the Adobe Reader.

HELP USING ADOBE READER

Adobe is very simple to use, and most of you have already used it in one form or another. However, should you need "help" with it, you can find all sorts of help on their website at www.adobe.com.

IRS_94x_and_EFTPS Help System - 07/31/06 6:30am Copyright © 2006, Roughneck Systems Inc.