EOY ›› End of Year Information ››

Adjust Vendor 1099 values

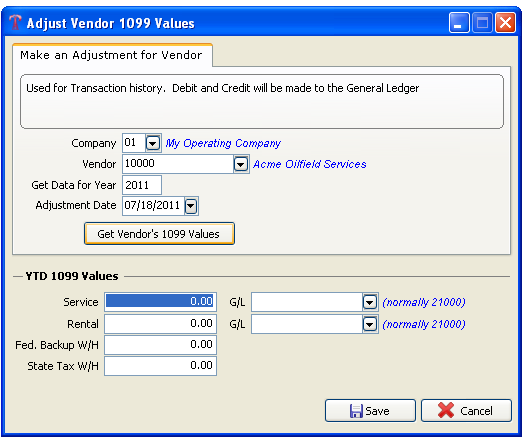

You can adjust values for Vendors that will only reflect on their 1099. No other files are affected.

How to make an adjustment for a Vendor:

Company: Your Company number

Vendor: Vendor number you wish to adjust

Get data for Year: The year you want to make your adjustment

Adjustment Date: The transaction date to assign the debit and credit for the adjustment

YTD 1099 Values

Service: YTD amount paid for vendor service. Updated only when Accounts Payable invoices are paid. Invoice number must end with the letter "S" to update the YTD Service amount.

Rental: YTD amount paid for vendor rentals. Updated only when Accounts Payable invoices are paid. Invoice number must end with the letter "R" to update the YTD Rental amount.

G/L Number: Normally 21000, Accounts Payable.

Federal Backup Withhold: See Federal Backup Withhold amount under Vendor

State Tax Withheld: See State Tax Withheld amount under Vendor.

Created with the Personal Edition of HelpNDoc: Easily create iPhone documentation