JIB ›› Tools/Settings for Op. Statements ››

Apply Min Check W/H to Accounts Receivable

This special routine allows you to post minimum check withheld amount towards outstanding Accounts Receivable invoices.

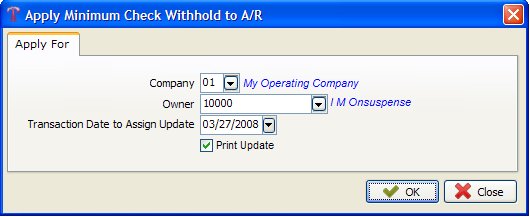

Select JIB - Tools for Statements - Apply to A/R - Apply Min Check W/H to A/R

APPLY MINIMUM CHECK WITHHOLD TO ACCOUNTS RECEIVABLE:

If an owner has a minimum withheld amount of $24.00 and owes $40.00 in Accounts Receivable invoices, you may apply this amount against the oldest Accounts Receivable invoice and reduce the amount he owes to $16.00.

Note: Operating Statements cannot apply his $24.00 minimum withheld toward Accounts Receivable invoices because he owes more in Accounts Receivable invoices than he has in minimum withheld. The owner does not have a positive check amount until his minimum exceeds his balance in Accounts Receivable.

RESTRICTIONS

You may only use this routine if an owner has a greater Accounts Receivable balance than his minimum withheld balance. If his minimum withheld balance is greater than his Accounts Receivable balance, you must run Operating Statements to cut a check for the remaining minimum withheld balance to be released.

HOW IT WORKS

The program will perform a sanity check to verify that the Accounts Receivable balance is greater than minimum withheld balance and that minimum withhold detail exist in the WHDINFO file for this owner. You will be prompted if the sanity check fails.

The minimum withheld amount will be applied as a payment record to the oldest Accounts Receivable invoice. The Accounts Receivable Inquiry report will indicate this as a minimum withheld. A credit will be posted to general ledger number 11300, Accounts Receivable and a debit will be posted to general ledger number 21011, minimum withhold in the Transaction file. The minimum withhold balance for this owner will be reduced to zero in the Owner/Customer file. The WHDINFO file will be updated for minimum withhold amount released.

You will be asked to print an Operating Statement for this owner reflecting the Accounts Receivable prior balance amount and minimum withhold release amount applied. The Operating Statement will show the remaining total amount the owner owes for Accounts Receivable invoices. A printout of the update for this owner will show the files updated when you applied the minimum withheld balance against Accounts Receivable invoices.

You may apply minimum withheld amount against Accounts Receivable invoices for only one owner at a time.

Related Topics

How to Use Minimum Check Amounts

Created with the Personal Edition of HelpNDoc: Full-featured EBook editor