Financials ››

The Cash Flow is a financial statement that shows how changes in balance sheet and income accounts affect cash flow. This statement lets the operator know if the company will be able to cover immediate expenses.

The Statement of Cash Flow reports the movement of cash into and out of your business in a given year. Cash is the lifeblood of your company. The cash flow statement reports your business’ sources and uses of cash and the beginning and ending values for cash and cash equivalents each year. It also includes the combined total change in cash and cash equivalents from all sources and uses of cash. This helps you have an accurate analysis of your company’s ability to meet its current liabilities.

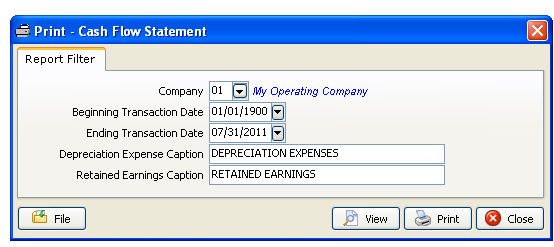

Select Financials - Company - Cash Flow Statement

How Cash Flow Works:

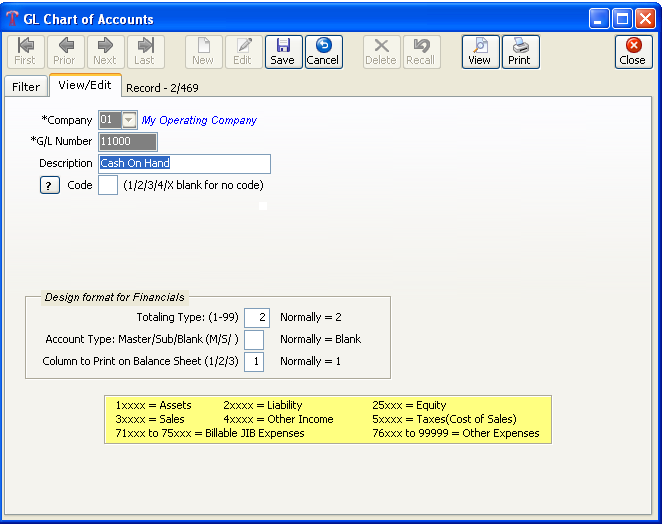

Each category of your Chart of Accounts will need to be coded if the account is to be used for your Cash Flow report. Locate the first General Ledger account you want to use on the Cash Flow and click "Edit". This is where you enter the 'Cashcode' that this General Ledger number belongs to (see below). You do not have to use every single General Ledger Account; it is up to you as to what accounts you want included. Also, keep in mind that your Company Chart of Accounts may be slightly categorized differently from the groups below. It will all depend on what categories cannot be changed. X will always be for 'Depreciation Expenses', 1 will always be for 'Operating', 2 for 'Investing', 3 for 'Financing' and 4 for 'Cash Accounts'.

Cashcode Where it prints on Cash Flow

X Depreciation Expenses

1 Operating

2 Investing

3 Financing

4 Cash Accounts

Depreciation Expenses:

G/L numbers between 76350 - 99999 with a cashcode of X

Operating:

Current Assets: G/L numbers between 11101 - 11199 with a cashcode of 1

Accounts Receivable: G/L numbers between 11300 - 11399 with a cashcode of 1

Other Assets: G/L numbers between 11400 - 14999 with a cashcode of 1

Current Liabilities: G/L numbers between 20000 - 21999 with a cashcode of 1

Investing:

Property, Plant & Equipment G/L numbers between 11200 - 12999 with a cashcode of 2

Other Assets: G/L numbers between 15000 - 19999 with a cashcode of 2

Financing:

Long Term Debt: G/L numbers between 22000 - 24999 with a cashcode of 3

Retained Earnings: G/L numbers between 25000 - 29999 with a cashcode of 3

Cash Accounts:

Current Assets (Cash Accounts): G/L numbers between 10000 - 11100 with a cashcode of 4

*Cash accounts beginning balances will equal ending balance for prior month

**The total of the first 4 parts (Depreciation, Operating, Investing & Financing) will equal the Net Increase (Decrease) in Cash on cash flow report

Created with the Personal Edition of HelpNDoc: Free EPub and documentation generator