Payroll ››

The Payroll Features configuration in the Setup Options menu under File on your tool bar and can be used to "Show payroll transaction on Financial Reports" and to change the field special deduction 1 to state tax. Calculation of a state tax is not standard in the Derek, because of the varying nature of this calculation for different states. This value must be looked up in your state tax tables and input during posting of the hours.

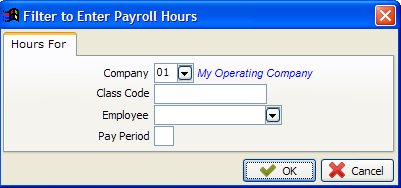

Select Payroll - Enter Hours

Enter the Employee to be paid or leave blank for all Employees, then click OK.

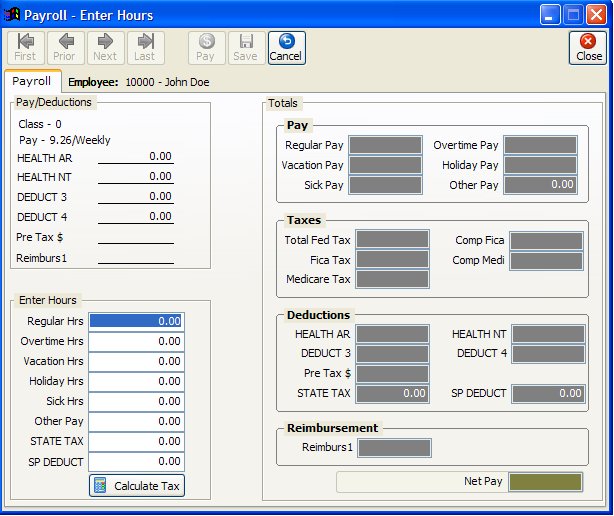

Click the Pay button, Enter the hours, then click Calculate Tax. Save the entries, then pay the Next one or Exit.

PROCEDURE FOR PAYING EMPLOYEES (ONE COMPANY AT A TIME)

All employees MUST be given hours to receive a check, even salaried people.

1. Post hours for payment to the employees

2. Print Payroll Register and verify for accuracy

3. Print the Payroll checks

4. Update the payroll

If you need to post hours again for another company, class code, employee or pay period, then the entire process is repeated.

NOTES ON FIELDS TO PAY EMPLOYEES

COMPANY NUMBER: You can only pay employees for one company at a time, because of the verification checks performed.

CLASS CODE: Leaving a field blank lets you post hours for all class codes. If you enter a value for this field, then only employees assigned to that class code are accessed.

This field is used to make sub-groups of employees within a company. Some operators have a need to obtain separate Payroll Registers for groups of employees, usually for insurance purposes. Other operators have no need for this sub-grouping and assign all employees to the same class code. Class codes are assigned to employees in their employee file.

EMPLOYEE NUMBER: Leave this field blank and all employees are accessed, otherwise only the employee specified is accessed.

PAY PERIOD: Leaving the field blank accesses employees in all pay periods. To specify a particular pay period enter ‘W’ for weekly, ‘B’ for bi-weekly (every 2 weeks), ‘S’ for semi-monthly (twice a month), or ‘M’ for monthly. Enter hours and other pay in the Enter Hours module. After entering all values the paycheck is calculated in the paycheck window. Regular pay is based on the rate stored in the Employee file as either the annual salary or hourly rate. Normally, regular hours for pay periods will be entered as follows:

40 HRS for a WEEKLY PAYROLL

80 HRS for a BI-WEEKLY PAYROLL

86.66 HRS for a SEMI-MONTHLY PAYROLL

173.33 HRS for a MONTHLY PAYROLL

EDITING THE CALCULATED PAY (CHECK)

The net pay calculated by Derek may vary by a few pennies from the look-up tables of the Circular E. Derek calculates the net pay to two decimal places with the third decimal being rounded up or down. You can change the values calculated by using the pay/edit button and then clicking the calculate tax button, which moves you to the paycheck window. The pay values are calculated immediately after you finish entering hours and click on the calculate tax button. After posting hours for employees, you should print the Payroll Register to verify for accuracy, print the checks, and then update for that company.

SPEC DED 1 AND 2: These deductions vary in amounts each pay period and are entered every time you pay the employee.

STATE TAX: Special deduction 1 can be used to enter the state tax, by assigning state tax to this field in File on your tool bar under Setup Options, Payroll Features. Use the Payroll programs to pay the employees.

Created with the Personal Edition of HelpNDoc: Produce electronic books easily