EOY ›› End of Year Information ››

This report is normally printed prior to printing the actual Government Forms to verify accuracy and owner's 1099 amount that will be printed. The report lists gross year to date revenue, year to date tax, and cumulative year to date expenses by general ledger categories from the JIBHIST file.

Select EOY - 1099 Reports

The 1099 reports also reflect a plus sign (+) for wells located in New Mexico. The JIBHIST file is checked for owner’s gross revenue, tax and year to date expenses incurred on each well. The 1099 report reflects the total New Mexico revenue each owner has earned at the bottom of the report. A separate 1099-Miscellaneous form should be reported to the state of New Mexico for the owner’s revenue earned in New Mexico. See New Mexico 1099 Misc. Forms.

The 1099 report indicates the 1099 amounts and in which block on the 1099 miscellaneous form the amount will print. Most operators send this report along with the 1099 form to the Investor for information purposes.

The 1099 report reflects an asterisk (*) for wells located in Oklahoma and the county code for these units. In the Unit/Well file, wells located only in Oklahoma require a county code number. The JIBHIST file is checked for owner’s gross revenue, tax and year to date expenses incurred on each well. The 1099 report reflects the total Oklahoma revenue each owner has earned at the bottom of the report. A separate 1099-Miscellaneous form should be reported to the state of Oklahoma for the owner’s revenue earned in Oklahoma. See Oklahoma 1099 Misc. Forms.

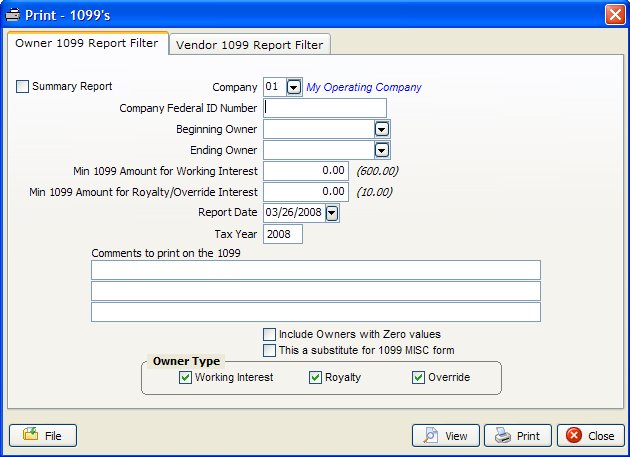

The tax year will now print on the 1099 Owner report. For those of you that have to file by E-file, we have added a filter asking if this is a substitute for 1099 MISC. Form. If you say yes, the 1099 Owner report will reflect this is a substitute for a 1099 MISC. Form.

The heading descriptions from your Company Chart of Accounts for general ledger number 30000 and general ledger number 50000 will now be reflected on the Owner 1099 report. The 1099 report will show the descriptions from your Company Chart of Accounts. Some operators refer to 50000 as cost of sale other operators like taxes/deductions. Normally depress Enter for both filters to print for all owners, otherwise specify a beginning and ending owner. This report reads year to date revenue, tax and expense values in the JIBHIST file. It also reads the federal backup withhold amount and the state tax withhold amount in the Customer/Owner file. Values are affected after update for Operating Statements.

Summary Report - This report will give you a list of all Owners Royalties, Federal Income Tax Withheld, Non-employee Compensation and State Tax Withheld.

Created with the Personal Edition of HelpNDoc: What is a Help Authoring tool?