Tools ›› Data Tools ››

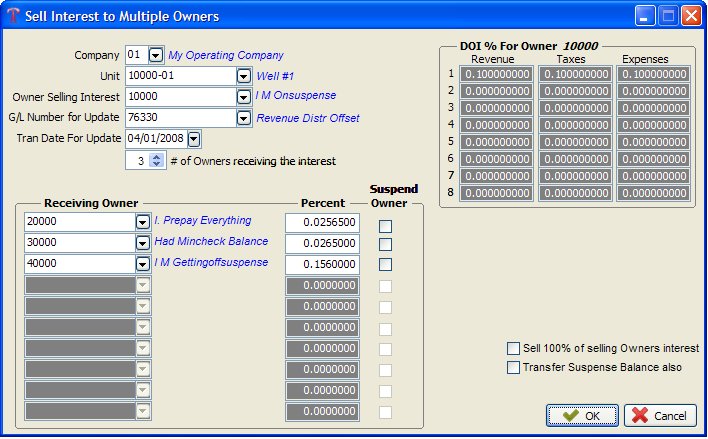

Allows you to transfer Interest percentage from one owner to one or more owners. When an owner has sold his Interest in a unit to another owner, percentages for the selling owner are transferred to the receiving owners.

Select Tools - Data Tools - Sell Owners Interest

You must use the same owner type to transfer interest for the same unit. If owner types are different for a unit, you need to assign a new owner number for the same type owner.

Enter the owner selling his interest and the unit. After entering selling owners number, ensure the owners name is correct. You will then be asked if the interest is to be equally distributed. If ‘Yes’ you will be asked for the total number of owners. You can sell interest to as many as 10 owners at a time. The % share is the portion of the selling owner’s interest that the new owner receives. To sell 100% enter 1, for 1/8 enter 0.125, for 1/4 enter 0.25 etc… For instance, your selling owner has 50% of a well and you want to sell his interest equally among four owners you would enter .25 as the percent. (25% *.50 = .125 for each Owner). Four owners times .125 each equals 50%. You have now equally distributed the selling owners 50% to the four receiving owners. Make sure to check the receiving owners name after entering their respective owner number.

If the selling owner is a working interest owner, his percent for revenue, taxes and expense for all status levels will be transferred to the receiving owner. The selling owner's percentage in the DOI will be reduced. The receiving owner's percent will be increased by that percentage in the DOI file. Revenue, taxes and expenses released are not changed for either owner.

Royalty and override owners will transfer revenue and tax percentages only. They do not have a percent for expenses. No journal entries will be made for transfer of interest or suspense balance except for owner number 99990-99999.

Before Interest is transferred, you should print the Released Suspense Revenue Detail report from the JIB module and/or the Non-Released Suspense Revenue Detail report from the JIB module.

NOTES ON FIELDS

UNIT NUMBER: Enter the unit number the selling owner has an interest percent in. All percentages in all status levels for the selling owner will be reduced in the DOI. The owners receiving the interest will be increased in the DOI by the percentages supplied. Owner types within a unit must be the same for each owner. If owner types do not match, you need to assign a new owner number for the same owner type. Selling owners interest in all units will transfer all interest to the receiving owner in all units.

OWNER SELLING HIS INTEREST: Enter owner number for person who is selling his interest.

G/L NUMBER FOR UPDATE: General ledger number for update only applies when transferring to owner number's 99990-99999. The general ledger account, 21010 will be debited for net life to date suspense amount for the selling owner and a credit to 76330 revenue offset will be generated in the Transaction file. The selling owner did not receive a check and his suspense amount is in the cash account. A transaction was made to credit 21010 (suspense amount) for his net suspense amount and a debit to 76330 (revenue offset) for his amount of net revenue.

The DOI for owner range 99990-99999 will update gross revenue released year to date and tax released year to date for the amount of suspense transferred. The DOI for the selling owner's suspense transferred will be reset to zero.

TRANSACTION DATE TO ASSIGN FOR UPDATE: Default date will appear for posting to the Transaction file for transferring suspense to owner numbers 99990-99999.

NUMBER OF OWNERS RECEIVING THE INTEREST: Enter the number of people who are receiving the interest. The receiving owners must reside in the Owner/Customer file.

SELL 100% OF SELLING OWNERS INTEREST: If the owner is selling all of his interest on this well select this box.

TRANSFER SUSPENSE BALANCES, ALSO: If suspense balances are transferred, the selling owner's net revenue amount in suspense life to date and tax suspense amount life to date will be reduced. The receiving owner’s suspense fields will be updated for the amount transferred for the unit in the DOI file. No transactions will be made for transferring suspense balances. Suspense status will not be changed for either owner.

Before interest is zeroed for either owner, you should print the Released Suspense Revenue Detail report and print Non-Released Suspense Revenue Detail report. Once the selling owner's percent is zeroed in the DOI file, you cannot print the Released Suspense Revenue Detail report or print Non-Released Suspense Revenue Detail report for a zero percent. Any suspense revenue released for the selling owner must have a beginning and ending suspense date in the DOI file to print prior Released Suspense Revenue Detail report.

You must have a beginning suspense date if the selling owner has always been on suspense to print the Non-Released Suspense Revenue Detail report.

PRINT SELLING INTEREST REPORT: This filter allows you to print a report showing the selling owner's and receiving owner(s) interest. You should print the selling interest report to have a record of the selling owner and the receiving owner's interest percents before and after transfer. If you choose not to print this report you will have no record of what the interest was before it was transferred. You will not be able to print this report at a later date.

The screen will display owner who sold his interest and owners who received his interest. If suspense balances have been transferred the suspense amount fields will be displayed. Accounts Receivable balances or minimum withhold amounts are not transferred when selling owners interest.

OWNER NUMBERS 99990-99999: Only owner numbers from 99990-99999 will create transactions in the Transactions file. A debit to 21010, suspense revenue and a credit to 76330, Revenue Distribution offset will be made in the Transaction file for the selling owner when life to date net revenue suspense is transferred to receiving owner numbers 99990-99999. No transactions were created for this range of owner number's when Operating Statements were generated for them. This range of owner numbers will not be issued a check.

Created with the Personal Edition of HelpNDoc: Easy EPub and documentation editor