Adding Service Charge for Past Dues

For adding a Service Charge to Past Due Invoices.

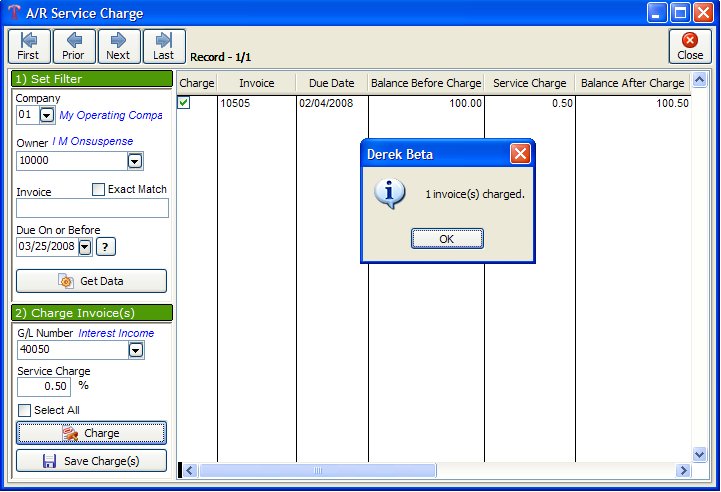

Select Accounts Receivable - Service Charges

You will need to enter in the Company Number and Owner name. Enter in the Due On or Before date. Invoices that are past due as of the specified Due Date can have a Service Charge added to them. A JEC is added to the invoice increasing the Invoice Balance. In the Transaction file, A/R is debited and the GL number entered is credited. You may charge this one invoice, or Select All the next invoices that's past due. If you choose to select All for all owner then all invoices that are past due as of the application date will be charged for all owners. Be careful not to apply a service charge to the same invoice more than once for the same application date. If you do double post to the same invoice, use the Edit/Delete routine to remove the posting.

A JED is added to the invoices increasing the invoice balance. In the Transaction file, a debit is posted to Accounts Receivable (11300) and a credit to the account you specify normally an income account (4xxxx).

NOTES ON FILTER FIELDS FOR SERVICE CHARGES

COMPANY NUMBER: You can post service charges for one company at a time.

OWNER/CUSTOMER NUMBER: The owner or customer must reside in the Owner/Customer file and should have an outstanding past due Accounts Receivable invoice. Enter the owner number and you may see all past due invoices for this owner. You may select to charge it, or select next invoice.

INVOICE NUMBER: The owner/customer must have outstanding Accounts Receivable invoices that are past due as of the specified application date in the Accounts Receivable file. You may enter the invoice number, leave the invoice number blank to Scroll the invoices, or 'A' to charge ALL invoices past due as of the specified application date.

GENERAL LEDGER NUMBER TO CREDIT: The general ledger number should be an income account number (4xxxx) for the credit. Accounts Receivable is automatically debited.

SERVICE CHARGE PERCENTAGE: Enter the percentage in decimal form to be multiplied by the invoice balance for the service charge (10.0=10%).

DUE ON OR BEFORE: This date will be used to update the Transaction file for the debit and credit and will be the application date of the JED in the invoice file. The application date is the date that is compared to the due date to determine if the invoice is past due.

Created with the Personal Edition of HelpNDoc: Create HTML Help, DOC, PDF and print manuals from 1 single source