State Tax Report for Non-Residents

Some states require special reporting on certain types of Owners.

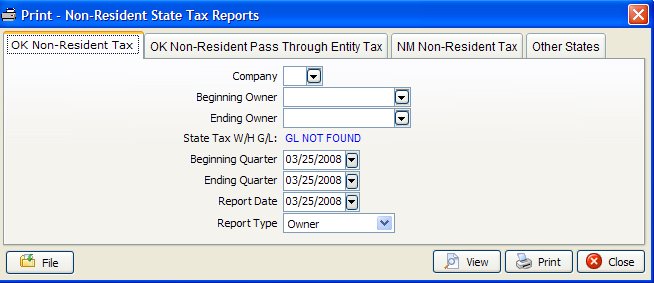

Select JIB - Other Reports - Non-Resident State Tax Reports

OK NON-RESIDENT STATE TAX (ROYALTY AND OVERRIDE OWNERS ONLY)

This report will check the Division of Interest file to make sure the owner’s are coded ‘R’ for royalty or ‘O’ for override. Then it will check the Unit/Well file to make sure the unit is located in the state of Oklahoma. After collecting that information, the report looks in the Transaction file for the state tax withholding journal entries coded with the general ledger number you used for state tax withholding on this report. When it finds the entries, it divides each state tax withholding percentage (0.0625) to get the revenue paid amounts per owner. Your percentage rate can be found under File, Setup Options on your tool bar. This information is being reported to the Oklahoma Tax Commission.

This tax only applies to Royalty and Override owners, not Working Interest owners, who live outside the state of Oklahoma but receive money from producing wells in Oklahoma. No corporations and no Indians. Consult your CPA if in doubt.

OK PASS THROUGH ENTITY STATE TAX (ALL OWNERS)

This report will check the Unit/Well file to make sure the unit is located in the state of Oklahoma. This report is used for non-residents of Oklahoma. After collecting that information, the report looks in the Transaction file for the state tax withholding journal entries coded with the general ledger number you used for state tax withholding on this report. When it finds the entries, it divides each state tax withholding percentage (0.0500) to get the revenue paid amounts per owner. Your percentage rate can be found under File, Setup Options on your tool bar. This information is being reported to Oklahoma Tax Commission.

NM (ALL OWNERS) NON-RESIDENT STATE TAX

This report will check the Unit/Well file to make sure the unit is located in the state of New Mexico. After collecting that information, the report looks in the Transaction file for the state tax withholding journal entries coded with the general ledger number you used for state tax withholding on this report. When it finds the entries, it divides each state tax withholding percentage (0.0625) to get the revenue paid amounts per owner. Your percentage rate can be found under File, Setup Options on your tool bar. This information is being reported to the New Mexico Tax Commission.

This tax only applies to owners who live outside the state of New Mexico but receive money from producing wells in the state. No corporations and no Indians. Consult your CPA if in doubt.

WITHHOLD STATE TAX (OTHER STATES)

Some states (i.e. California) have a state tax withhold rate for owners that are non-residents and receive income.

This report will check the Owner/Customer file to make sure the ‘Withhold State Tax’ field is checked. After collecting that information, the report looks in the Transaction and Year to Date Transaction files for the state tax withholding journal entries coded with the general ledger number you used for state tax withholding on this report. When it finds the entries, it divides each state tax withholding percentage (0.0715) to get the revenue paid amounts per owner. Your percentage rate can be found under File, Setup Options on your tool bar.

Created with the Personal Edition of HelpNDoc: Free help authoring tool