JIB ›› Other Reports ››

If an owner has a federal backup withhold tax percent or state tax withheld field is checked in the Owner/Customer File, tax will be withheld when Operating Statements have been run.

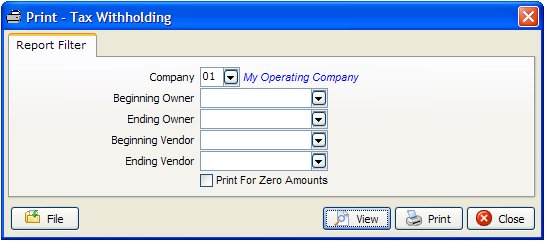

Select JIB - Other Reports - Tax Withholding Other States

The year to date federal tax withhold or year to date state tax withhold will be printed on owner's 1099 form. The report will list the federal rate of withholding percent and if the owner has state tax withheld. State tax withheld is not state sales tax. It is a non-resident state income tax. California and Oklahoma operators who pay Investors or vendors that do not live in the state of California or Oklahoma must withhold a non-resident state tax.

If the vendor has a federal backup withhold tax percent and or state tax withheld field is checked in the Vendor file, tax will be withheld when Accounts Payable invoices are paid. Vendors are subject to federal backup withholding tax and state tax on gross income received.

When Accounts Payable invoices are paid, tax will be deducted from the vendor's check. Federal backup withhold tax and or state tax withheld will be read from the Vendor file and printed on the Vendor 1099 Forms.

Created with the Personal Edition of HelpNDoc: Write eBooks for the Kindle