File Maintenance Structures ››

Vendors are used for the Accounts Payable System.

TIME SAVER

If you have multiple companies, and the same vendor is used for a different company, use the carry add feature after all fields have been entered for the vendor or you can also use the Quick Copy Tool, to quickly copy Vendors from One Company to Another.

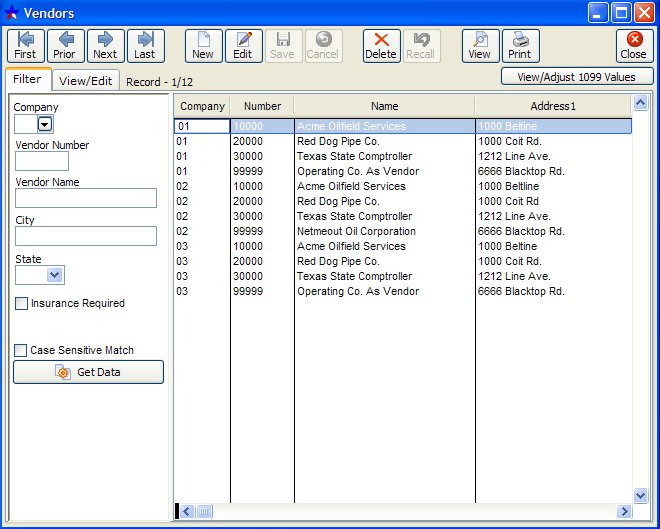

Select File Maintenance - Vendor File

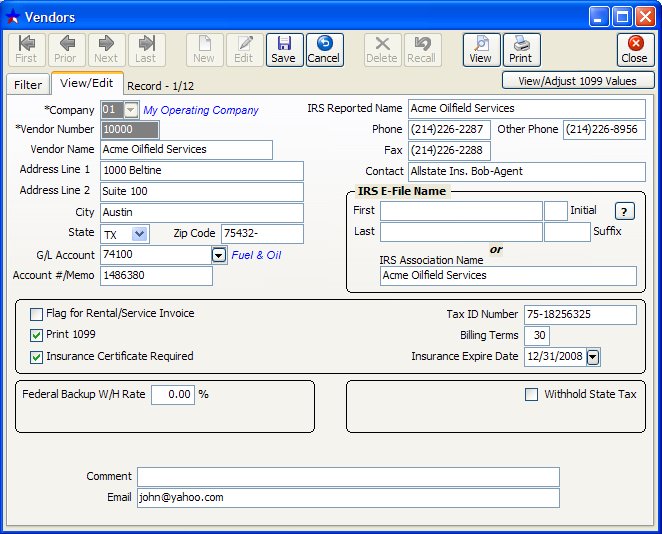

The Vendor file stores the vendor’s name, address, email address, insurance certificate if required, year to date federal backup and state tax withholding amounts. Vendors are people that you buy products or services FROM.

Note: In order to get all records of a file, the Filter conditions must be blank, otherwise it will only list records that were contained in the previous filter.

NOTES ON FIELDS

COMPANY NUMBER: Your company number for this vendor.

VENDOR NUMBER: Any 5-character code. May be number or character. If number needs to be changed in the future, you must go to Tools, Data Tools then Key Code Change. Refer to the Tools section in Manual.

Note: If you have more than one company and If different companies use the same owner, customer, vendor or employee, you must assign him to each company. Otherwise the transactions for each company, 1099, W-2 info, etc..., is not kept properly. Remember, at the end of the year, it is a company that issues Government Forms 1099, W-2's, etc... You can use the same code number for the same person in each company, since the addition of the company number will distinguish its index key from the same record in a different company (SMITJ01 vs. SMITJ02).

VENDOR NAME: Vendor name or company.

ADDRESS LINE 1: First line of the address.

ADDRESS LINE 2: Second line of the address. If no second address line is needed leave blank.

CITY: City of the vendor.

STATE: State of the vendor. If the vendor is in Oklahoma any 1099 service/rental values will be reflected on the Oklahoma 1099 forms.

ZIP CODE: Zip code of the vendor.

GL ACCOUNT: You can enter a GL number that a Vendor only uses so when you add an A/P, Run Check or GL Transaction invoice then the GL number you entered will pop up. This saves keystrokes and time from looking up GL numbers.

ACCOUNT NUMBER/MEMO: You can add a Vendors account number or just a memo that you want to print on your A/P Checks or Quick Checks. To print the account number or memo on the checks you will need to go to File, Setup Options, Check Setup and select A/P Checks and then you should see a Memo field, select Yes under the Print It field.

IRS REPORTED NAME: If the Vendor has a different name he/she reports to the IRS then this is where you would input it. Example: John & Jane Doe is in the Name field but, only John wanted to report it then you could enter John Doe in the IRS Report Name field.

PHONE/FAX NUMBER: Phone and fax number of vendor.

OTHER PHONE: A Vendor’s mobile, work, pager or home phone number could go here.

CONTACT: Vendor contact name.

EMAIL ADDRESS: Vendor email address.

IRS E-FILE NAME: E-Filing requires that the Vendor name be separated into First, Middle Initial, and Last names. If you are not sending to a person's name, then you need to assign an IRS Association Name.

FLAG FOR RENTAL/SERVICE INVOICE: If vendor is checked, Accounts Payable program warns you to add an 'R' for rental or 'S' for service invoice. Only rental or service invoices will be updated for 1099's. When the service or rental invoice is paid, the amount will be updated to the Vendor file, under view/adjust 1099 values.

PRINT 1099's: If a vendor is not checked, a Government Form 1099 will not be printed for this vendor. Performing a 1099 sanity check will check values and print error messages.

INSURANCE CERTIFICATE REQUIRED: Vendor may be required to have an insurance certificate. If checked, you need to enter the insurance expiration date.

TAX ID NUMBER: Vendor Federal ID or Social Security Number.

BILLING TERMS: Net due in number of days. 0=COD, 30=Due in 30 days. This field is used to automatically calculate the date due for Accounts Payable invoices. For example, if terms = 30, then 30 days are added to the date of the invoice to determine the due date of the invoice.

INSURANCE EXPIRATION DATE: If insurance certificate is not required, you will not be asked for the expiration date. If an insurance expiration date is valid until otherwise notified, enter a date of 12/31/2007. When posting Accounts Payable manual or computer checks, the programs will check the insurance required field in the Vendor file. If the vendor requires insurance and the insurance expiration date on file has expired (5 days prior to actual expiration), the program flags the expired date and the option to either pay or skip the invoice. A new expiration date may be assigned in the Vendor file. Insurance required criteria and insurance expiration dates would print on the Vendor report.

FEDERAL BACKUP WITHHOLDING RATE: If a vendor does not provide a Tax ID number, you must withhold backup withholding. The federal backup withholding rate is 31% for U.S. citizens, and 30% for nonresident aliens, (0%=don't withhold). Backup withhold amount must be reported to the IRS on your 941 quarterly reports. Deposits should be made in accordance with backup withholding federal deposit regulations. Refer to IRS Circular E instructions concerning backup withholding.

FEDERAL BACKUP WITHHOLD AMOUNT: Amount withheld this year for federal backup withholding will be found under the View/Adjust 1099 amount on the View/Edit screen. Used for 1099's. If federal backup withhold rate is 31%; this rate will calculate backup amount for each invoice paid to this vendor. The backup withhold amount will be deducted from the gross invoice and stored in the year to date federal backup withhold field when the invoice is paid. The check amount for an invoice will be less the backup withheld amount. Year to date backup withhold amount will be printed on the vendor 1099 form in box 4. Company total report for federal backup withhold amounts may be printed in the JIB program.

WITHHOLD STATE TAX: Some states (i.e. California) have a state tax withhold percentage rate for vendors that are non-residents and receive Income. The state tax rate is stored in Setup Options under File on your tool bar. If withhold state tax is checked, the state tax rate will calculate state tax amount from invoices paid. If a vendor is not checked, ‘No’ state tax is withheld.

STATE TAX WITHHELD: Amount withheld this year for state tax will be found under the View/Adjust 1099 amount on the View/Edit screen. Used for 1099's. If withhold state tax field is checked ‘Yes’ in the Vendor file, the state tax rate entered in Setup Options will calculate state tax. The amount paid to the vendor will be less state tax withheld from the gross invoice. Your company total report for year to date state tax withhold amounts may be printed in the JIB program under Other Reports. Refer to your state regulations for depositing state tax withhold amounts.

COMMENT: Any additional information for the vendor.

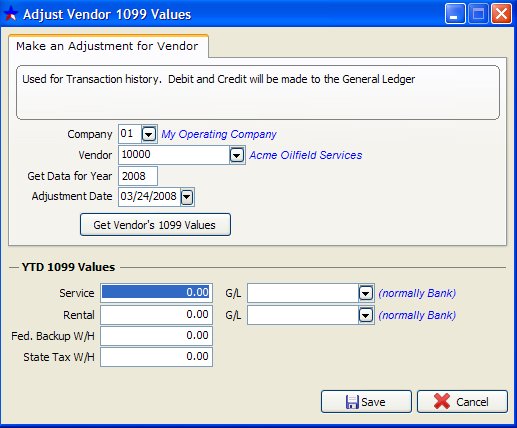

VIEW/ADJUST 1099 VALUES

This option allows you to view or make Vendor 1099 adjustments. When you make an adjustment, a Debit and Credit is made to the Transaction file.

You can adjust values for Vendors that will only reflect on their 1099. No other files are affected.

How to make an adjustment for a Vendor:

Company: Your Company number

Vendor: Vendor number you wish to adjust

Get data for Year: The year you want to make your adjustment

Adjustment Date: The transaction date to assign the debit and credit for the adjustment

YTD 1099 Values:

Service: YTD amount paid for vendor service. Updated only when Accounts Payable invoices are paid. Invoice number must end with the letter "S" to update the YTD Service amount.

Rental: YTD amount paid for vendor rentals. Updated only when Accounts Payable invoices are paid. Invoice number must end with the letter "R" to update the YTD Rental amount.

G/L Number: Normally the Bank

Federal Backup Withhold: See Federal Backup Withhold amount under Vendor

State Tax Withheld: See State Tax Withheld amount under Vendor.

Related Topics

How to Navigate the Master Files ~ Government Forms

Created with the Personal Edition of HelpNDoc: Write eBooks for the Kindle