EOY ›› End of Year Information ››

CREATE FEDERAL 1099 E-File

This section is for "Federal 1099 E-filing" or for Printing the 1099 Forms, not for "State" filing.

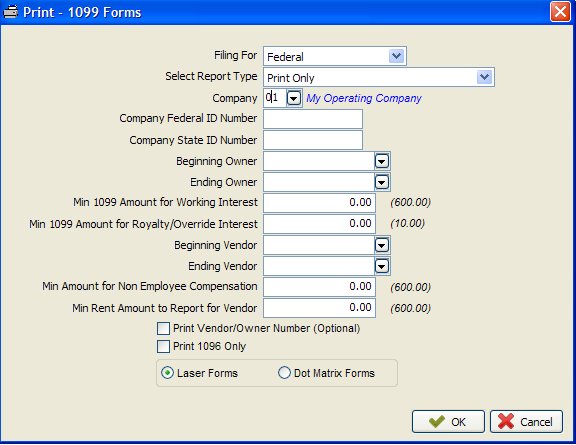

Select EOY - 1099 Forms/E-File

For "Select Report Type" you can choose from "Print & Create E-File", which will print the 1099 Forms on pre-printed Form paper, and then create an E-File that can be transmitted to the I.R.S. via the internet. "Print Only" will only print the Form. And "Create E-File Only" will only create the I.R.S. required E-File and save it, whereby you can transmit it later.

Select your desired company number, and depress <Enter> key through rest of fields, accepting the Company Federal ID Number for selected Company. Then click "OK".

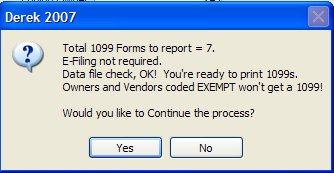

The system will then perform a sanity check and alert you if there are any obvious errors, if so you correct them before continuing.

NOTE: You are only "required" to E-File when there are 250 or more forms submitted. However, you can still elect to E-File by clicking "Yes" when you are flagged.

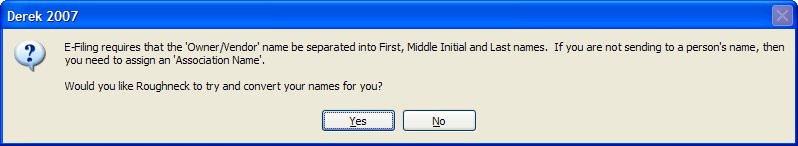

Click "Yes" to have Derek see if it can convert your Owner and Vendor names for you. You will immediately be provided a listing of the converted name structures in your master files, first for Owners and secondly for Vendors. You can print this new list for reference. To make any changes, from the Main Menu select File Maintenance - Owner/Vendor, click on the Address tab and you will see the I.R.S. names.

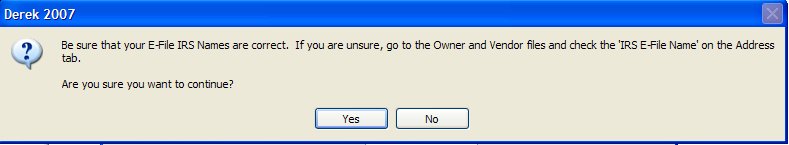

Click "Yes" when satisfied with your converted names and continue. Otherwise, exit and make any manual changes to Names using the File Maintenance routines.

Derek will allow you to E-File regardless of how many 1099 forms you have. Check with your CPA or State and I.R.S for submitting requirements.

After printing an alignment 1099 form, check it and if needed make necessary corrections until it is aligned correctly for your specific printer.

Next, you will be asked about a 1096 Form. You can either print the 1096 form now or not.

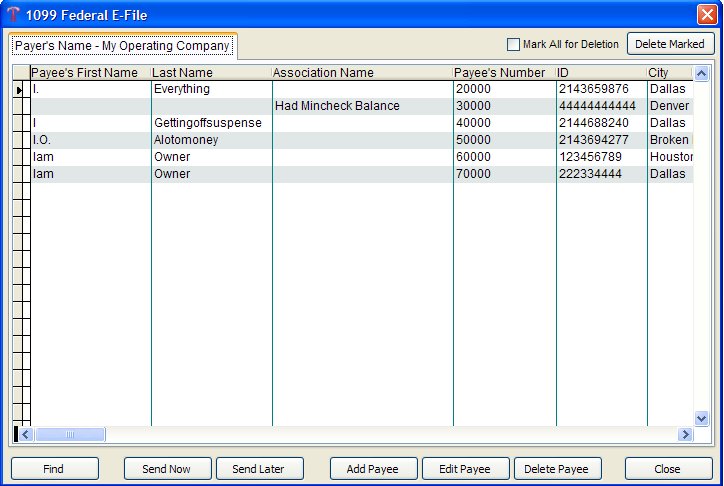

The E-File is displayed (below). You can save a copy of your file, by clicking "Send Later", make changes, and/or "Send Now".

When you are ready to send the E-File, click "Send Now".

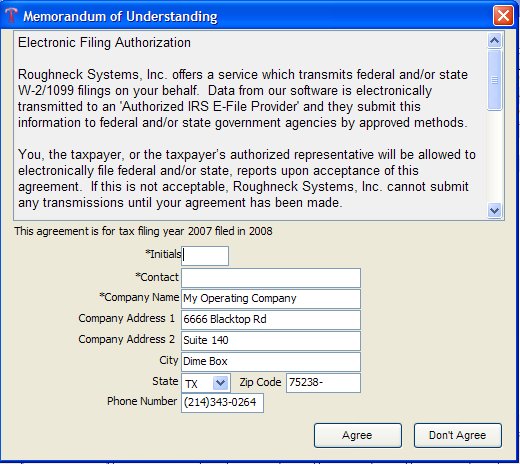

Once you Click on Send Now you will have the "Memorandum of Understanding" come up. You will need to read over it then enter your company information.

You will need to know your Username and Password before continuing.

SEND LATER

If you are not ready to E-File your 1099’s you can save the file by selecting the ‘Send Later’ button. You will then need to enter in a name you want Derek to save the file (Ex: 2011tax). Click OK. You can send this file later by going to EOY, Send E-files/Check Status then Send Saved 1099 E-file. Once you go into your Send Saved 1099 E-Files you have the option to view an E-file name. Once you view the file you can Edit the Payee or Send Now.

ADD PAYEE

You are able to add a Payee that is NOT going to be added anywhere else in Derek. This new Payee will be submitted with your E-file batch.

CLOSE

The Close button will take you completely out of the E-File process and you will need to start again, unless you previously saved a File to which you can access after closing.

SEND NOW OPTIONS

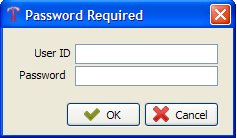

First you will be asked to save a copy of your file. Then you will be asked for your User ID and Password, as an added precaution.

Enter your User ID and Password, as configured in the Company Headings Master file, and click ok. The Transmit Confirmation screen will appear.

PRINT RECEIPT

We strongly suggest you Print the Receipt first thing.

MAKING PAYMENT USING CREDIT CARD

After clicking "Pay Now", complete the Payment form that appears to make payment by Credit Card. Click "Pay" and your payment will be transmitted.

MAKING PAYMENT USING "BILL ME"

If you select the Bill Me option then you will receive a bill of the amount shown, from Derek, and your file will be transmitted immediately.

FINISHED

You are finished for the Federal for the Company specified in your original filter. You will be returned to the first Filter Screen. Repeat the process for each Company and/or State as required by you.

TO CHECK STATUS OF SUBMITTED REPORTS

You can check the status of your reports by the following.

From the Main Menu Select EOY - Send E-File/Check Status - Check Status

Created with the Personal Edition of HelpNDoc: Full-featured Kindle eBooks generator