Transactions ››

This is a system used to enter any kind of General Journal Entry - a Debit and a Credit.

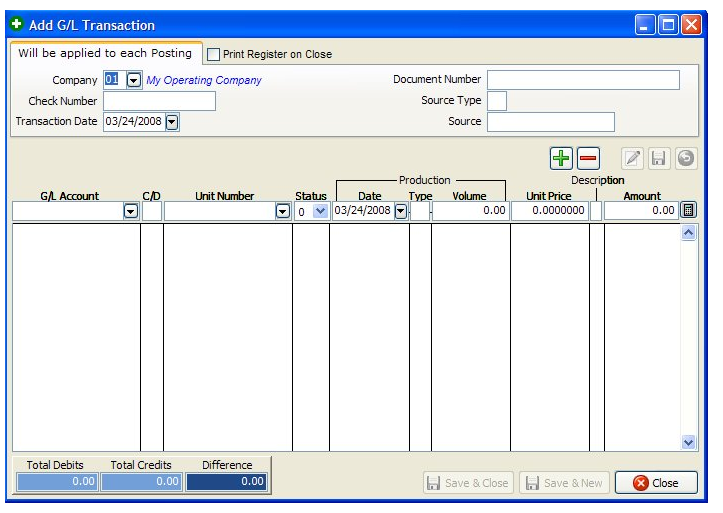

Select Transactions - Add G/L Transaction

NOTES ON FIELDS FOR ADD G/L TRANSACTIONS:

COMPANY NUMBER: Company to be used when adding the Journal Entry.

CHECK NUMBER: Used to update the Bank and Transaction file.

TRANSACTION DATE: This date is used when specifying beginning and ending dates for Operating Statements, printing reports, etc...

DOCUMENT NUMBER: Used as a trace number for the check or invoice. Normally for Cash Disbursements use the check number. Amount of check and check number will be updated to the Bank program.

SOURCE TYPE: Source type could be a C for Customer, O for Owner, V for Vendor, E for Employee or you could just leave it blank.

SOURCE NUMBER: Code number for above source type. For example, if you put in a Source type V, then you would need to enter in a Vendor number for the Source number.

G/L ACCOUNT: The account number used for posting debit and credit entries tot he General Ledger. The G/L used must reside in Company Chart of Accounts. For every credit entry, you must have a debit entry to keep the G/L in balance.

CREDIT/DEBIT: 'C' for Credit or 'D' for debit to general ledger number above. Sales are usually credited and taxes and expenses are usually debited.

UNIT NUMBER: Normally, the well number. If you don't enter a unit number, the transaction is not used when printing Operating Statements.

DOI STATUS LEVEL: Used here the same as for the Accounts Payable Invoice. The status indicates which percentage in the DOI file to use for each investor. The Status defaults to the status value stored in the Unit file, allowing you to depress the <enter> key to quickly accept the default value or you can change the status to be used. If NO Unit number is entered the status defaults to zero.

OIL/GAS PRODUCTION DATE: This is only necessary when entering a run check. Production type is used to trigger printing a volume on the Operating Statement and to update the Unit/Well file with production history volumes. Use O for oil and G for gas. Production volume will not be used if type is not O or G. This field is not used here when entering the make believe Cash Disbursement, since it is not a run check and has no bearing on any production volume.

UNIT PRICE: Only necessary when entering a run check and it is the price per unit in MCF's or BBL's. Some states now require this to be printed on the Operating Statements.

DESCRIPTION: The Description defaults to the GL description used in your Company Chart of Accounts. However, if you change the Description, the new (extra) description will also be printed on Operating Statements. The description of the GL account is always printed on Operating Statements and usually that is enough. But if you want more than the G/L description, enter it here, and both descriptions will be printed on Operating Statements.

AMOUNT: Enter the amount to be posted for this record. After entering the amount, select the '+' sign or depress the <enter> key twice.

MINUS SIGN: Anything that has previously been saved can be deleted.Select the transaction to delete by clicking on it one time, then click the minus sign to delete it.

EDIT POSTING: You can edit any entry just added. Select the transaction to edit by clicking on it one time, then click the 'pencil button' to edit it. Make necessary changes to the entry and click the 'diskette' button to save.

SAVE & CLOSE: Click this button to save all added entries and exit the Transaction File.

SAVE & NEW: Click this button to save all added entries and start a new Transaction.

Created with the Personal Edition of HelpNDoc: Free Web Help generator