File Maintenance Structures ››

The GL Number on a transaction indicates to Derek whether the item should be used in such routines as Printing Operating Statements or some other routine of Derek. For example, if a transaction has a GL number of 71xxx-75xxx, Derek knows it is a billable expense to investors and it will be included on the Operating Statement run that corresponds to the transaction date.

Chart of Accounts = a series of GL accounts

Company Chart of Accounts = keeps track of individual GL Accounts for a Company

Unit(Well) Chart of Accounts = keeps track of individual Expense and Revenue items for a Unit/Well

You must set-up a Chart of Accounts for each Company and each Unit or Well. Certain GL Numbers for the Chart of Accounts are reserved, see GL Number Restrictions below. The printing of the P & L, Balance Sheet and Operating Statements are triggered by general ledger code numbers, such as assets, liabilities, billable expenses, sales, taxes/deductions etc…

TIME SAVER:

If you have multiple companies, once you setup a Chart of Accounts for One Company, you can use the Quick Copy Tool, to quickly copy the Chart of Accounts to another company. Same with Units or Wells. To save time setting up companies and units, you can copy a Chart of Accounts from one company to another or from one company to a unit (the current month and year to date balance figures are not copied). After copying the accounts, you can go to File Maintenance on your tool bar to make any additions, changes or deletions for the new company or unit.

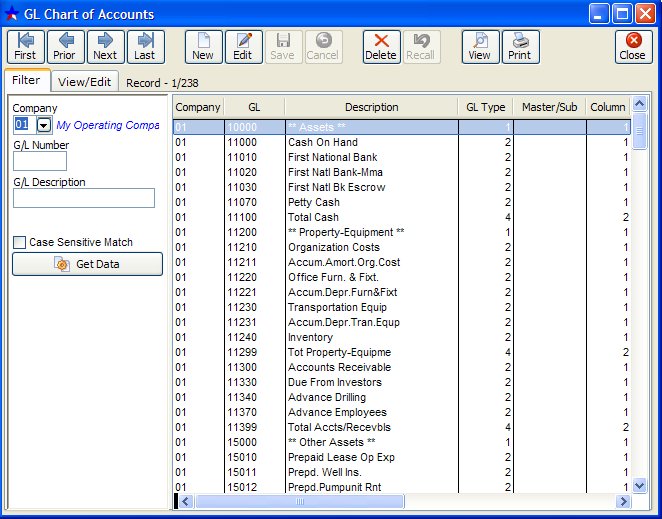

Select File Maintenance - Company Chart of Accounts

Each company must have a Company Chart of Accounts. The Company Chart of Account file stores the general ledger number with the description. The design format for financials such as the totaling type, account type, and the column to print on balance sheet should be set up here.

Note: In order to display all records of a file, the Filter conditions must be blank, otherwise it will only list records that were contained in the previous filter.

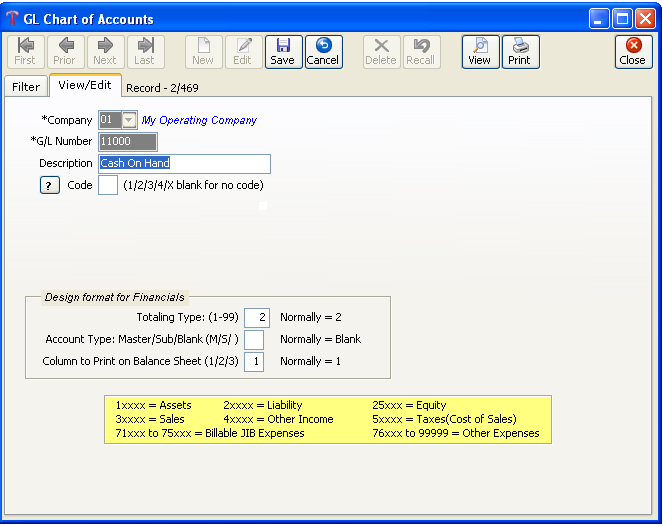

NOTES ON FIELDS:

Company Number: The company number this G/L number will be assigned to.

GL Description: Your personalized description for this account. If GL Number needs to be changed in the future, you must go through Tools, Data Tools, Key Code Change. Refer to Tools section in Manual.

Code: Used only if you also have the Cash Flow Statement. The cashcode information is located in this Help Manual in the Financials section under Cash Flow Statement.

Totaling Type (1 to 99):

Type 1 accounts are title accounts only and are not open for transactions (debits and credits). An example might be assets, current income, cost of sales, liabilities, office expenses, billable expenses, non-billable expenses, etc…, where these headings are desirable in the printing of the Balance Sheet or Income Statement.

Type 2 accounts are open for transactions (debits and credits). These are your normal accounts that are used when posting to the general ledger. Only Type 2 accounts can have transactions entered for them.

Types 3 to 95 totaling accounts and only used to print a subtotal on the financial statements. Type 2 accounts total into the next larger type, likewise all type 3 accounts will total into the next larger type, and so forth.

Account Type (Master, Sub or Blank):

Enables summarizing of accounts. Only general ledger numbers with account type of M or BLANK are printed on the financial statements.

Account Type = M is a master account and will be printed on the financial statement. The amount that will be printed will be the total of it and all immediately following 'S' (sub-accounts) accounts. Only accounts with account type of M or blank are printed.

Account Type = S is a SUB account of the preceding master account. The amounts for SUB accounts are added into the preceding master account and are not printed on the financial by themselves. All S's following an M are totaled into the preceding M account.

Account Type = ' ' (blank) are printed as one line item and stop the totaling process for account types.

Column to Print:

Sub accounts do not print on financials.

Blank account, usually printed in column 1.

Master or totaling accounts 3 or higher usually printed in column 2.

Total assets and total liabilities are usually printed in column 3 on balance sheet.

Column to Print on Balance Sheet (1, 2 or 3):

This field is only used when printing the Balance Sheet. It designates which column to print the amount on the Balance Sheet. If the column equals 1, the amount will be printed in the first column. Column equals 2, and the amount is printed in column 2. Column equals 3, and the amount is printed in column 3. This code does not affect any report other than the Balance Sheet.

GL NUMBER RESTRICTIONS:

See the sample data printout for an example. Use the sample data Company Chart of Accounts file for a guide on assigning these codes: See also Accounting for Dummies

Categories

You must use numbers here, no characters. Proper coding of the Company Chart of Accounts allows for consolidated and individual reporting of companies within a parent organization.

The x's represent the numbers that you fill in for the individual account. For example, 11010 would be an asset account.

For Billable Expenses to Investors:

71xxx Expense Category 1 (Heading can be changed in the JIB Program)

72xxx Expense Category 2

73xxx Expense Category 3

74xxx Expense Category 4

75xxx Expense Category 5

For Billable Company Charges to Investors:

These accounts are billed as expenses to the owners but are treated as income for your company on the Unit P & L reports. Most operators use general ledger numbers 74171 to 74189 for their company charges to owners for items such as; administration for operating the wells, pumper, etc... To enter a company charge to Investors, you normally debit the expense (74171 to 74189) and credit income using the Add Recurrent Transactions program.

The G/L Numbers used for Company Charges MUST be in sequence since the Unit P&L for Company Interest will ask for a Beginning and Ending G/L Number for Company Charges.

If you need to change your Company Charges for G/L Numbers so they are in sequence, use the Key Code Change program in Tools under Data Tools. This tool will change the G/L Number in all files (G/L, Unit G/L, Transaction, YTD Transactions, etc...).

For Non-Billable Expenses to Investors:

76xxx to 99999 general ledger numbers not billed to Investors. Usually items such as rent, office supplies, etc... These are not billed to the Investors.

For Disbursable Revenue to Investors:

(3xxxx) Revenue from run checks, etc... This revenue is disbursed to Investors. To enter a run check, you normally credit revenue (3xxxx) for the gross amount of the check, debit taxes and cost of sale (5xxxx) for the tax amount, and debit cash (1xxxx) for the net amount of the check.

For Disbursable Taxes/Deductions (from Sales of Oil/Gas/etc) to Investors:

(5xxxx) These are taxes /deductions from revenue disbursed to the Investors. This includes all owners; Override, Royalty and Working Interest.

For Income Not Disbursed to Investors:

(4xxxx) Interest income, income from company charges to Investors, etc… This income is not disbursed to the Investors.

REQUIRED GL NUMBERS:

The following general ledger numbers must exist in your Company Chart of Accounts for proper interaction.

11300-Accounts Receivable. Needed to make the automatic posting for all entries made through Accounts Receivable. Derek always debits or credits this account and never asks for this number. You only supply the general ledger number for the other half of the transaction.

21000-Accounts Payable. Just like Accounts Receivable.

21010-Suspense Revenue Withhold. When owners are coded as being on suspense, this account is used for their net revenue.

21011-Min. Check Amount Withhold. When owner’s net revenue amount does not exceed the amount you specified for the minimum check amounts.

21040-Backup Withhold Taxes Payable. When owners or vendors do not provide Tax ID number.

21045-Nonresident State Tax Payable. California, New Mexico and Oklahoma require operators to collect state tax on non-residents of their state. You should setup a new GL Number for each state. Ex: 21046- Oklahoma Non Resident Tax, 21047- New Mexico Non Resident Tax.

23200-Sales Tax Payable. Used in Accounts Receivable.

23300-Freight Payable. Used in Accounts Receivable.

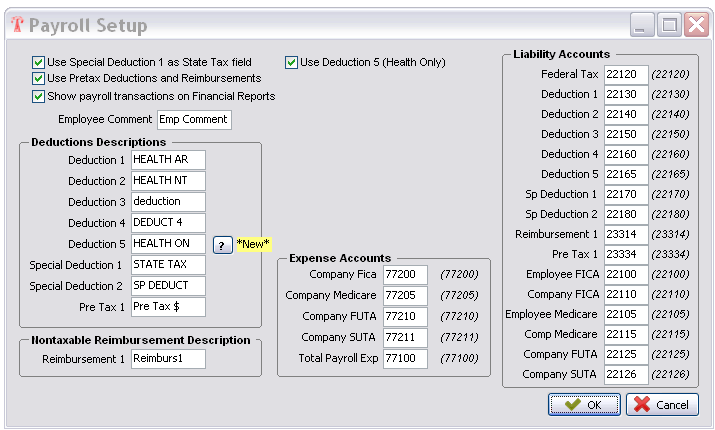

23314-Reimbursement. This is a non-taxable Payroll reimbursement.

23334-Pre-Tax Deduction. This is a Pre-Taxable Payroll deduction.

25300-Retained Earnings, must be a Type 2. Used to post beginning balance forward to general ledger.

29700-Current Net Income, Must be Type 1. Used to calculate current income on reports.

76320-JIB Offset. Used to offset expenses billed to owners when Operating Statements are updated.

76330-Revenue Offset. Used to offset revenue disbursed to owners when Operating Statements and checks are updated.

NOTE on JIB and Revenue Offset Numbers: When updating the Operating Statements, you need some type of offset account for both expenses and revenue. The expense offset is normally called the JIB offset and the revenue offset is surprisingly called the revenue offset. You do not have to use the numbers 76320 and 76330 for these two offset accounts. All other numbers above must exist as is (no changes).

Payroll GL Numbers:

If you select to make Payroll interactive to the general ledger you need the following accounts. These general ledger numbers may be modified using Setup Options under File on your tool bar. However, no two numbers should be the same. Use a separate number for each expense/liability. All payroll accounts are normally type 2.

Related Topics

How to Navigate the Master Files ~ Oil & Gas Business for Dummies ~ Accounting for Dummies ~ Quick Copy Tool

Created with the Personal Edition of HelpNDoc: What is a Help Authoring tool?