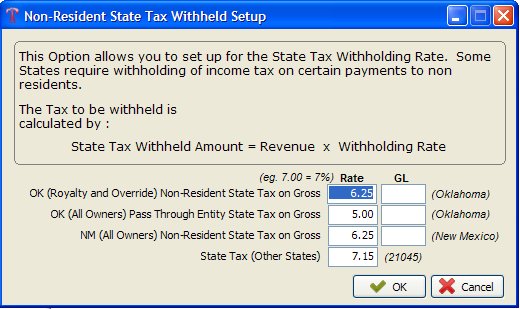

Select File - Setup Options - State Tax Withholding

This option allows you to set up for the State Tax Withholding Rate. Some states require withholding of income tax on certain payments to non-residents. You may also refer to the Owner/Customer file under ‘Tax Help’ for more information. For tax rates, please contact your state for more information.

Non-resident state tax withheld setup. Some states (i.e. California) require withholding of state tax on certain payments to non-residents. The state tax to be withheld is calculated by:

State Tax Withheld Amount =(State Tax Withholding Rate) X (Gross Income) |

State tax withheld would apply to payments to vendors, and revenue income paid to owners and customers.

This option allows you to set up a State Tax Withholding Rate for the state of the Operator, not the Vendor, Owner or Customer's State of Residence. The State Tax to be withheld is computed at TAX WITHHOLDING RATE multiplied times Gross Income. However, withholding is not required if payment to a payee is less than the State Tax Withholding limit in a calendar year. Check with your State concerning the State Tax Withholding limit. States vary regarding State Tax limit; therefore the Operator is responsible for State Tax limit.

Enter State Tax Withholding Rate like 7.00 = 7 percent

State tax rate is computed at tax withholding rate X gross income. Owners and vendors may be subject to state tax withholding for a non-resident. Withhold state tax is located in the Owner and Vendor file for each owner or vendor. If the field, 'Withhold State Tax', is marked 'Y', the state tax withholding amount will be computed for this owner or vendor and stored in the field year to date state tax withheld in their Master file.

NOTES ON VENDOR STATE TAX WITHHOLD

If the vendor is marked ‘Withhold State Tax’ in the Vendor file, the rate will be computed on the gross accounts payable invoice amount when paid.

The state tax amount will be deducted from Accounts Payable gross invoice for this vendor. State tax withheld will be updated to the Vendor file when this invoice is paid. The amount of state tax withheld is stored in the Vendor file, year to date state tax withhold field. The year to date state tax withheld amount will be printed on Vendor 1099's in the block indicated for state tax.

NOTES ON OWNER STATE TAX WITHHOLD

If owner is marked withhold state tax in the Owner/Customer file, the state tax rate will be computed on all gross revenue, general ledger numbers 3xxxx for Operating Statements for this owner.

The state tax amount will be deducted from gross revenue on the Operating Statement for this owner on all wells. State tax withheld is by owner, not by well. State tax withheld will be updated by well in the DOI file to gross revenue released only if this owner is on suspense or has minimum check withheld. This amount was deducted from gross revenue as part of suspense balance or minimum check withhold amount. The amount of state tax withheld is stored in the Owner/Customer file year to date state tax withheld field. The year to date state tax withheld amount will be printed on Owner 1099's in the block for sate tax.

Created with the Personal Edition of HelpNDoc: Easy CHM and documentation editor