File Maintenance Structures ›› Payroll Tax Table ››

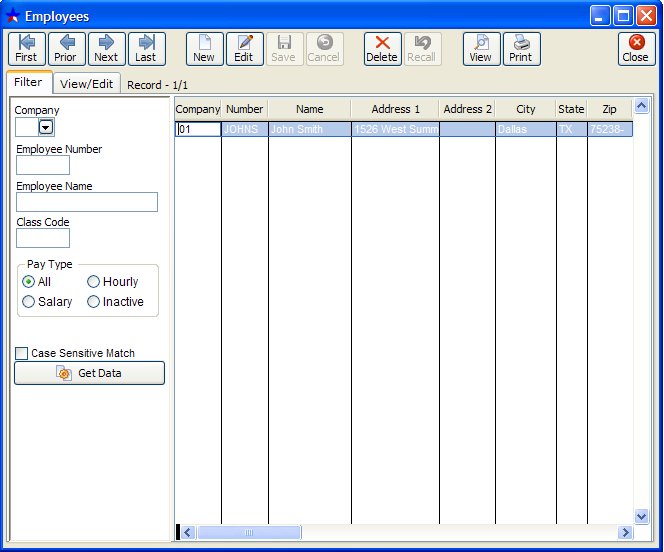

Select File Maintenance - Employee

You can make the Payroll programs Show payroll transactions on Financial reports and assign special deduction 1 to the state tax by using Payroll Setup Options under File. The Payroll programs are interactive to the general ledger in the sample data. Add employees in the Employee file.

NOTE: In order to display all records of a file, the Filter conditions must be blank, otherwise it will only list records that were contained in the previous filter.

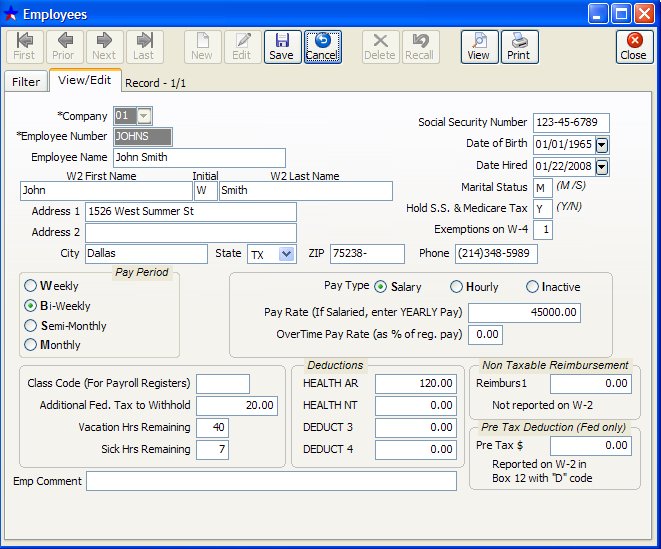

NOTES ON FIELDS:

EMPLOYEE NUMBER: Five-digit code number assigned to each employee.

NOTE: If you have more than one company and if different companies use the same owner, customer, vendor or employee, you must assign him to each company to track year to date information. Otherwise the year to date values for each company, 1099, W-2 info, etc..., is not kept properly. Remember, at the end of the year, it is a company that issues 1099's, W-2's, etc... You can use the same code number for the same person in each company, since the addition of the company number will distinguish its index key from the same record in a different company (SMITJ01 vs. SMITJ02).

EMPLOYEE NAME: The employee’s name as you would like it to appear on the checks and all payroll reports.

W2 FIRST NAME AND INITIAL: The format for the first name and initial that will print on the W2 form.

W2 LAST NAME: The format for the last name that will print on the W2 form

ADDRESS LINE 1 AND 2: Employee’s physical address as it would appear on the payroll check.

CITY: Employee’s city, as it would appear on their payroll check.

STATE: Employee’s state as it would appear on their payroll check.

ZIP CODE: Employee’s zip code as it would appear on their payroll check.

SOCIAL SECURITY NUMBER: Social security number needed for W-2's.

DATE OF BIRTH: This is the birthday of the Employee.

MARITAL STATUS: M = Married, S = Single

HOLD S.S. & MEDICARE TAXES: (i.e., Alien): United States citizens are responsible for paying FICA and Medicare taxes. Non citizens don't pay these taxes.

DATE HIRED: For your information, date first hired.

NUMBER OF EXEMPTIONS: Number of exemptions claimed on W-4.

PAY PERIOD (WEEKLY, BI-WEEKLY, SEMI-MONTHLY, MONTHLY): How often the employee is paid. This entry is critical for correct calculation of taxes withheld. Bi-weekly = paid every 2 weeks, Semi-monthly = paid twice each month. When you post hours for paying employees, you must enter the number of hours even if an employee is salaried.

Normally you will enter the following for regular hours, salaried employees.

40 HRS for a WEEKLY PAYROLL

80 HRS for a BI-WEEKLY PAYROLL

86.66 HRS for a SEMI-MONTHLY PAYROLL

173.33 HRS for a MONTHLY PAYROLL

TYPE (SALARIED, HOURLY, INACTIVE): Indicates whether an employee is a set salary, paid by the hour, or has been terminated. Inactive means the employee has been terminated. Inactive employee’s will not come up when you pay the employees, however, they must remain in the file until the end of the year for W-2's and government reports if they have received any wages.

PAY RATE (IF SALARIED, USE YEARLY PAY RATE): Salaried employees must have their yearly salary entered, for correct calculation of taxes to be withheld. For hourly employees, enter the hourly pay.

OVERTIME PAY RATE: This is usually 1.5 times his normal rate. This field does not apply to salaried employees.

CLASS CODE: Using this field lets you print and track payroll registers by class code. For example, code 1000 could be used for office help and code 2000 could be used for manual labor help.

ANY ADDITIONAL FEDERAL TAX TO WITHHOLD: If an employee, would like to have some additional federal tax withheld each pay period, enter the amount here. Additional federal tax is added to total federal tax withheld on Payroll reports.

VACATION HRS. REMAINING: The number of vacation hours remaining this year. This is not a critical field, but is updated when you pay vacation hours. 0=None

SICK HRS. REMAINING: Number of sick hours remaining this year. Again this not a critical field, but is updated when you pay sick hours. 0=None

DEDUCTIONS TAKEN OUT EVERY PAY PERIOD: There are 4 deduction fields for automatic deductions each pay period. For example, insurance may be deduction 1; uniforms may be deduction 2, etc… Use Payroll Features under Setup Options under File on your tool bar to enter description for the deductions.

NON TAXABLE REIMBURSEMENT: This amount will not be reported on the Employee’s W-2 form. The GL number suggested for reimbursement is 23314. To change the description or GL number go to File, Setup Options then Payroll Features.

PRE TAX DEDUCTION (FEDERAL ONLY): This amount is reported on the Employee’s W-2 form in Box 12 with “D” code. The GL number suggested for Pre Tax is 23334. To change the description or GL number go to File, Setup Options then Payroll Features.

EMP COMMENT: This is a field of your choice. It will show Emp Comment at first but, you can change the heading description under File, Setup Options then Payroll Features.

Related Topics

How to Navigate the Master Files ~ SetUp Features for Payroll ~ How to Change Format of the Checks ~ Checks Used by Derek ~ How to Format Names for W2 Printing

Created with the Personal Edition of HelpNDoc: Write EPub books for the iPad