JE = Journal Entry = Journal Entry Credit or Journal Entry Debit

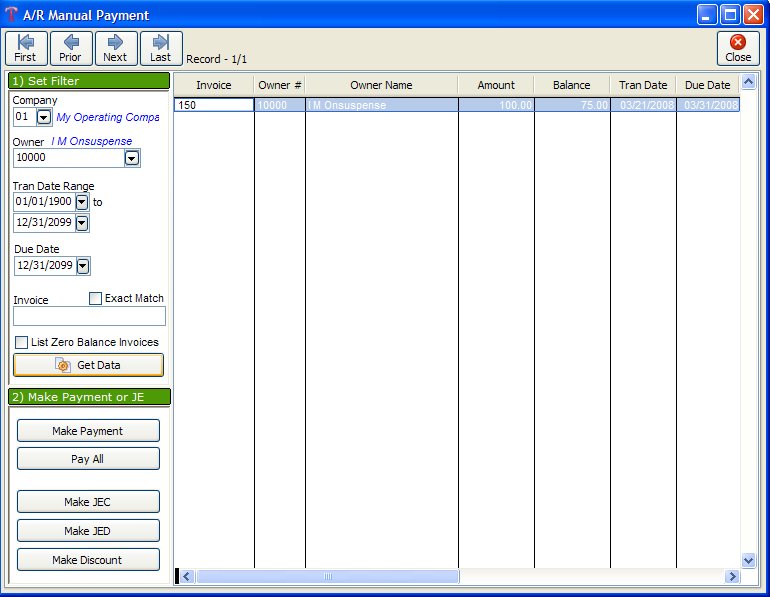

This routine is used most often to enter payments received from Investors. It is easier if you have a recent Accounts Receivable Inquiry report for reference.

MAKE PAYMENTS

Select Accounts Receivable - Make Payment or JE's

CHOOSE MAKE PAYMENT OR PAY ALL

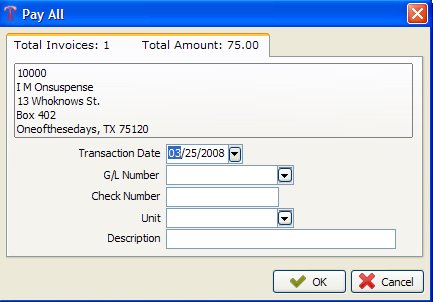

This option is used to pay or post a journal entry application to each individual invoice number. Also used to see invoices or pay all invoices for an owner. To see all invoices for an owner, leave the invoice number field blank then click on your Get Data button. This will display all invoice(s) on file for the owner specified. The Pay All option is only available for Payment applications. To pay all invoices of an owner, click on the Pay All button. You will notice the total amount for that Owner in the top right hand corner. You will need to enter the Transaction date, general ledger number (normally your checking account) and check number, unit number and a description.

The debit is to your checking account. A credit is automatically made to 11300, Accounts Receivable. A credit will decrease Accounts Receivable balance. A debit to your checking account will increase the bank balance.

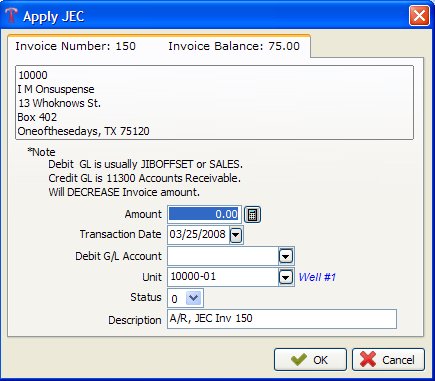

CHOOSE MAKE JEC

The debit is normally to your JIB Offset or Sales account and the credit is to A/R. Using this option will Decrease your Invoice amount.

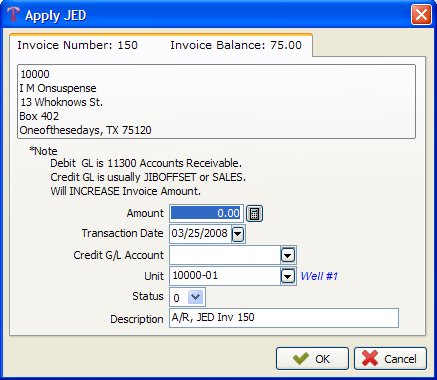

CHOOSE MAKE JED

The credit is normally to your JIB Offset or Sales account and the debit is to A/R. Using this option will Increase your Invoice amount.

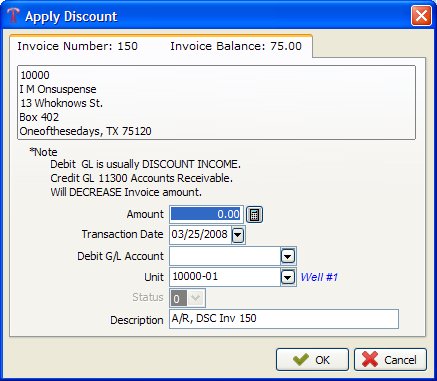

CHOOSE MAKE DISCOUNT

The debit is normally to your Discount Income account and the credit is to A/R. Using this option will Decrease your Invoice amount.

NOTES ON FILTER FIELDS FOR PAYING ACCOUNTS RECEIVABLE INVOICES

COMPANY NUMBER: The Company this invoice will be assigned to.

OWNER/CUSTOMER NUMBER: The owner or customer this invoice will be assigned to.

INVOICE NUMBER: You can enter a specific invoice number and only that invoice will be accessed.

ACCOUNTS RECEIVABLE JOURNAL ENTRY DEBIT

The credit general ledger number is usually the JIB OFFSET account (GL number 76320 of the sample data - see GL Number Restrictions) for invoices automatically added from the Operating Statement update. However, if the invoice was entered through Add in the Accounts Receivable Programs, you should credit the general ledger number that was credited there (usually that is a cash account). In other words, credit whatever was debited when the invoice was entered.

Created with the Personal Edition of HelpNDoc: Easily create EBooks