This routine is normally used keep track of money your Company owes to Vendors. Used to track invoices from Vendors and their payments.

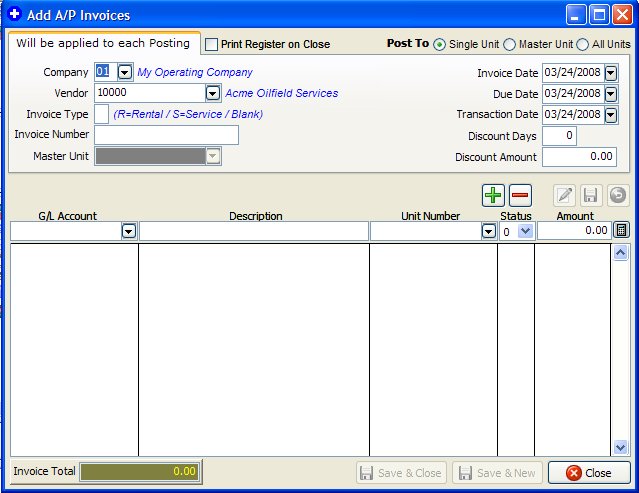

Select A/P - Add Invoices

NOTES ON A/P INVOICE FIELDS

For Fields not used, or to accept the Default Value for a Field, you may depress the <enter> key to bypass.

INVOICE NUMBER: You can use up to 19 characters for the invoice number. Alpha characters are acceptable.

NOTE: To enter a credit Invoice, the last character of the Invoice Number must be a "C".

TYPE (R/S/BLANK): To enter a Service or Rental Invoice, type in "S" or "R" respectively. This is appended to the end of the invoice number automatically. When invoices are Paid, Government Form 1099 values are updated in the Vendor file only if type is "R" or "S". Leaving this blank will not update any Government Form 1099 values in the vendor file. NOTE: When making an A/P credit invoice, entering "R" or "S" in the Type field will override the credit, since the "R" and "S" is appended to the end of the invoice number. However, the invoice will remain an A/P credit if the Type field is left blank (and there is a "C" to the end of the invoice number as stated above).

INVOICE DATE: This date always defaults to the Transaction Date, but may be changed. It is the date the invoice was incurred. The default Transaction Date always defaults to Today's Date, but can be changed by using Change Default Transaction Date.

DUE DATE: Date the Invoice becomes due. This date initially defaults to the Transaction Date. It is re-calculated after entering the Invoice Date from the Terms of the Vendor as stored in the Vendor file. The Terms of the Vendor, as stated in the Vendor Master file, are added to the Invoice Date to determine the Due Date.

TRANSACTION DATE: This date is used when specifying Beginning and Ending Dates for Operating Statements, Financial reports, etc…

DISCOUNT DAYS: Number of days within which you can pay the invoice and receive a discount.

DISCOUNT AMOUNT: This is the actual amount (not percentage) of the discount if you pay the invoice early (within the specified number of Discount Days).

G/L NUMBER: This is the Expense General Ledger Number that is debited. Do not use the Accounts Payable G/L Number 21000. Derek automatically posts a credit to Accounts Payable GL number 21000. Debits and credits are stored in the Transactions File. Investors are billed their share for G/L #’s in the range of 71001 to 75999 when Operating Statements are printed. See GL Number Restrictions and Accounting for Dummies for more.

DESCRIPTION: The Description defaults to the GL Description used in your Company Chart of Accounts. However, if you change the Description the new (extra) description will also be printed on Operating Statements. The description of the G/L account is always printed on Operating Statements and usually that is enough. But if you want more than the G/L description, enter it here, and both descriptions will be printed on Operating Statements.

UNIT NUMBER: This is normally the Well Number but the Unit Number could, in special situations, be used to denote a Group of Wells, a Lease, etc... Most operators always use this Number to designate a specific Well, but the choice is yours.

DOI STATUS LEVEL: Used to indicate which percentage in the DOI file to use for billing the Investors. In the Division of Interest file each Investor can have up to 8 different percentages on a Unit. For example, a percentage for Drilling, Completion, Normal Operating, etc… The status entered here for each transaction indicates which Expense percentage to use for investors from the Division of Interest File. For Example, if the status to use is 2, for Revenue, Tax, and Expense Transactions, then the percentages used from the DOI file would be REV2, TAX2, and EXP2. The status initially defaults to the status stored in the Unit file allowing you to depress the <enter> key to accept the default value. If no Unit Number is entered the Status defaults to 0.

AMOUNT: This is the amount for the line item of the invoice. If there is only one line item on an invoice, then of course this amount is the total amount.

NOTES ON POSTING TO MASTER UNIT:

The gross amount of invoice will be divided evenly among all units that belong to the master unit. Any rounding of pennies will be distributed to the last unit within the master unit if necessary. After the gross amount of invoice has been distributed evenly to each well, then that amount will be distributed accordingly to each investor as to what their individual percentage is.

STATUS LEVEL: The default status of each unit in the Unit/Well file will be used for billing Investors.

EDIT THIS RECORD: If a mistake is made while adding an invoice, you may change information for this record by selecting the edit button.

CREDIT INVOICES: Must have a "C" as the last character of the invoice number. Credit invoices are issued to Investors when you print the Operating Statements and revenue checks. Do NOT enter a negative amount for a credit invoice. Credit invoice amount will issue a check if there are no positive invoices when Operating Statements are run. If you do not wish to refund this credit, you need to have the Owner/Customer file say NO netout for this owner. NOTE: When making an A/P credit invoice, entering "R" or "S" the Type field will override the credit, since the "R" and "S" is appended to the end of the invoice number. However, the invoice will remain an A/P credit if the Type field is left blank (and there is a "C" to the end of the invoice number as stated above).

Created with the Personal Edition of HelpNDoc: Easily create iPhone documentation