JIB ››

Before you can print the Revenue checks, you must print or view Operating Statements! Because Check Printing uses the data stored in the temporary files (REVSTUB and REVTOTAL), that contain data for the last time you printed or viewed Operating Statements.

TUTORIAL SCENARIO

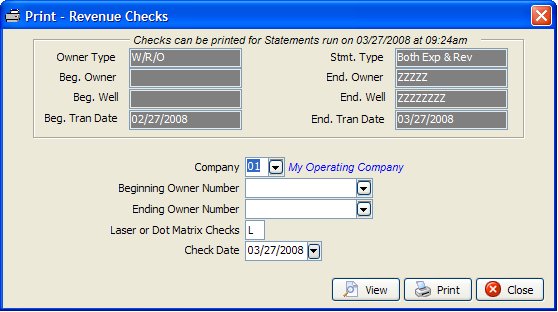

You can use regular paper and pretend you have checks loaded in your Printer. Print this for Company Number 01 and all other values as shown in the image EXCEPT FOR DATES and Laser or DotMatrix Checks. Use dates that will apply to the dates you entered for your transactions. Refer to the Notes on Fields if you need more info. Actual check formats can be Setup in Check Formats.

PRINT REVENUE CHECKS

Select JIB - Revenue Checks

The top section will show the filter conditions you used for printing Operating Statements.

After you click OK, Derek will ask if you want to print an alignment check. This is helpful to make sure the printing aligns correctly on your particular check. Actual Check Setup can be changed from File - Set Up Options - Check Setup.

Derek will prompt you with a dialog box that lets you know total number of checks needed for the print job.

Derek will ask for the beginning check number. It is assumed the checks will be numbered sequentially. The check number will be used to update the check field in your data files.

The checks will now print. In case of printer mishap, you will have the option of re-printing the checks.

Derek will ask if you want to print the Check Register. Select Yes.

Derek will ask, if you want to Update for Operating Statements and Checks. Normally select Yes, unless something has gone wrong or you have some other specific reason for not wanting to Update the files. See Update for Statements and Checks for more info on the Update.

Study the checks that printed and cross-reference them with the Operating Statements.

NOTES ON FIELDS

OWNER NUMBER: Leave blank for beginning and ending owners numbers to have statements print for all owners and all owner types W/R/O (Working Interest, Royalty and Override). However, you can specify a beginning and ending owner number to print selectively. These filters are usually only used when you need to re-print only a certain segment of the statements due to your printer messing up.

LASER OR DOT MATRIX CHECKS: Specify the type of printer you will use for checks. Actual Check Setup can be changed from File - Set Up Options - Check Setup.

NOTES ON PRINTING CHECKS

Check Format

If your revenue check stub prints detail information, the production date for sales and taxes is reflected instead of the transaction date. You can Change the Check Format. The check date is printed on the revenue check stub.

Checking Sanity of your Check File

The Sanity Check will verify that information exists in the REVTOTAL and REVSTUB file. Updates for expenses and revenue are stored in these files. If you ran Operating Statements for expenses only and owners had a credit for expenses, printing revenue checks would refund the credit to the owner if he had no positive expenses. The Owner/Customer file will be checked for either a "C" combine all balance forward or an "E" each unit will be netted according to netout in the DOI file. If a owner is not checked in the Owner/Customer file, no netout will be saved for this owner and the JIB credit invoice will remain in the Accounts Receivable program to be used against positive invoices next time.

Owners on Suspense do not receive a check.

Their money is stored in the JIBHIST file (after updating) until released. To place an Owner on suspense, the Suspense field in the DOI file must be marked yes and he must have a Beginning Suspense Date.

No check unless check amount exceeds Minimum Check Amount

If an Owners Net Revenue amount does not exceed the specified minimum check amount you set up in their Owner/Customer file, the dollar amounts are stored in their Owner/Customer file until they reach the specified minimum check amount. Once the specified amount is met, Derek will release the money to the owner when you run Operating Statements and Checks.

Net Outs

If an Owner is coded in his master file to be Netted Out, then the Expenses are subtracted from his Revenue amount.

Owner Numbers 99990 to 99999 do not get a check

Because they are reserved for you the Operator as an Owner or a Deleted Interest Owner who may receive Revenue from the purchaser. No cash transfers are made for these Owner Numbers. If you as the Operator and Owner want to receive a check use an Owner Number outside this range.

Created with the Personal Edition of HelpNDoc: What is a Help Authoring tool?