JIB ››

Update for Statements and Checks

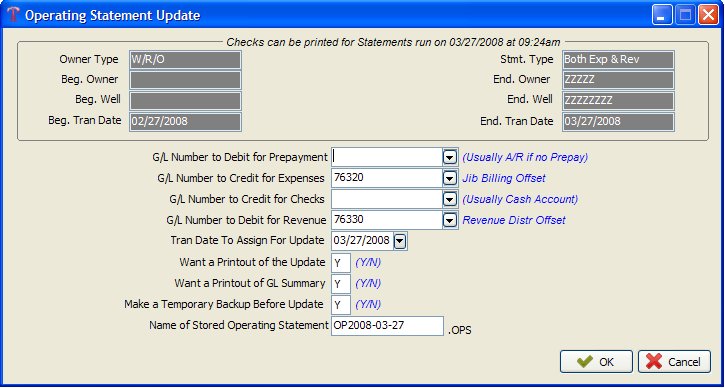

Nothing is updated in files until this routine, so in case you make an error printing Operating Statements or Checks, you can repeat the process. Before you can update, you must Print or View Operating Statements and Print or View checks! Updating uses data stored in the temporary update files (REVSTUB and REVTOTAL), that contain data for the last time you ran Operating Statements and Checks.

TUTORIAL SCENARIO

Run this Update for Company Number 01 and use dates that will apply to the dates you entered for your transactions. Refer to the Notes on Fields if you need more info.

Select JIB - Update Statements & Checks

You cannot use the <Esc> key to halt execution during updates.

NOTES ON FIELDS USED TO UPDATE OPERATING STATEMENTS

If you only ran statements for expenses or revenue, you still must supply all general ledger numbers. The prepayment general ledger number will only be used if there was a prepayment involved (in which case it will debit the prepayment general ledger), otherwise use the Accounts Receivable general ledger number for expenses. If you have no revenue, no transactions will be posted to your cash account or to the Revenue Offset account.

GL NUMBER TO DEBIT FOR PREPAYMENT: is only used when a prepayment was used from the DOI file on any owner during the Operating Statements. For owners where no prepayment was used, the system will automatically debit Accounts Receivable for the full amount of the expenses. The Sample Data for the DOI file used in Tutorial, had Owner 20000 that Prepaid on Well 10000-01 therefore we used GL Number 21015 which is used for Prepayments in the Sample Data Chart of Accounts for Company 01. See How to Use Prepayments for more.

GL NUMBER TO CREDIT FOR EXPENSES: is used as a credit account to offset the amount debited for the expenses but charged to Investors. This account 76320 - JIB Billing Offset is a Required GL Number in the GL Number Restrictions.

GL NUMBER TO CREDIT FOR CHECKS: One of your checking accounts. It's the account from which the money is withdrawn for the revenue checks. This account is credited. The Sample data used 11010 as the Checking Account at First National Bank.

GL NUMBER TO DEBIT FOR REVENUE: is used as a debit account to offset the amount credited to the revenue sales. This account 76330 - Revenue Distribution Offset is a Required GL Number in the GL Number Restrictions.

TRANSACTION DATE TO ASSIGN FOR UPDATE: is used as the transaction date for the debits and credits posted to the Transaction file and Accounts Receivable file. This date has no bearing on the posting to the DOI file for current month and year to date values of revenue, taxes and expenses, as it is assumed this update is for this year. If you are updating for an Owner that had the following: Federal Backup Withholding, OK Non-Resident State Tax, OK Pass Through State Tax, NM Non-Resident State Tax or State Tax Withheld (Other States) then Derek will automatically update the proper GL numbers in the transaction file.

WANT A PRINTOUT OF THE UPDATE: Always say yes. This is for your records of what operating statements were printed and updated.

WANT A PRINTOUT OF GL SUMMARY: If you said ‘yes’ to the printout of the Update, this report will automatically print. If you said ‘no’, then you should print this report. The printout of General Ledger Summary will list the general ledger numbers and description for general ledger numbers used during update of Operating Statements. Credit and debit totals for each general ledger number will be listed. We suggest you save the printout for General Ledger Summary to verify totals posted after each update of Operating Statements.

MAKE A TEMPORARY BACKUP BEFORE UPDATE: ALWAYS say YES. It is amazing the number of things that happen to folks. There is no reason you should not make this backup. Let the system make the Automatic Backup. Last item listed on the filter. For your own protection, please answer "YES" and allow the system to automatically make a backup of the files just in case of an error. Only files affected for updating of Operating Statements are backed up. If after update you need to restore data prior to the update you may use the Restore Operating Statement Backup. Selecting a printout of the update will detail for each owner on each unit, the files affected from the update of Operating Statements. It is a simple matter to Restore the Operating Statement Backup if necessary.

NAME OF STORED OPERATING STATEMENTS: Do not use spaces or any characters other than numbers and letters and dashes "-". This really causes errors to Microsoft Windows and clients do this a lot when creating names for files. A good example to use is OP-06302006. The name represents the year, month and day the Operating Statements were run.

Created with the Personal Edition of HelpNDoc: Easy CHM and documentation editor