This is the system used to enter any kind of general journal entry - a Debit and a Credit. You can enter any kind of General Journal Entry; also referred to as a General Ledger (G/L) Transaction. See Accounting for Dummies

TUTORIAL SCENARIO

This will be an example of making a Cash Disbursement - an expense that you have paid, most likely you issued a hand written check for this expense. It is entered by Adding A G/L Transaction. It does not go through Accounts Payable, since you already paid it. In accounting, a Cash Disbursement consists of debiting the Expense and crediting the Cash, both for the amount of the expense.

For a Cash Disbursement, you must enter two transactions, one for the credit to your Cash Account - G/L Number 10000 to 19999 (see your printout of Company Chart of Accounts) and the other to debit the Expense Account. If the expense is to be billed to the Investors, it should be debited to one of the Billable Expense G/L Numbers from 71000 to 75999. See GL Number Restrictions.

We will assume you wrote 2 manual checks (not computer generated checks) for 2 different Cash Disbursements.

$500 for Chemical Treatment (which is GL Number 74040 in the Sample data) on Well #1

$100 for Office Rent (GL Number 76200)

The Chemical Treatment check is a Billable Expense to Investors. See GL Number Restrictions.

The Office Rent check is NOT billable to Investors.

Both checks were written on your Cash Account in the First National Bank (11010). Note: The Bank program will be updated for the check written.

To enter Both Disbursements, you will:

Debit 74040 for 500 dollars (Chemical Treatment Check)

Credit 11010 for 500 dollars.

Debit 76200 for 100 dollars (Office Rent Check)

Credit 11010 for 100 dollars.

ENTER JOURNAL ENTRIES FOR A CASH DISBURSEMENT

Select Transactions - Add G/L Transaction

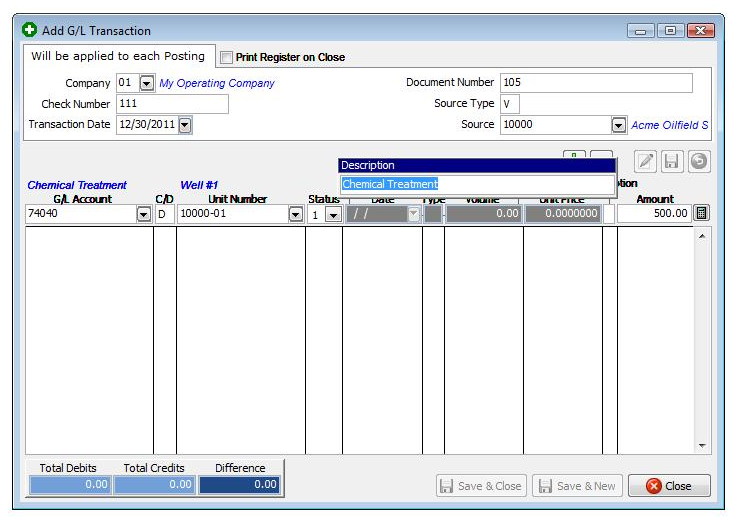

Debit for the Chemical Treatment by entering values as appear on above image. Then Click the "Add Item" button and the entry is moved to bottom screen display.

Now you will enter the Credit on the same line you entered the above Debit.

To Credit First National Bank account for Check Number 111, complete as in image above. Then Click the "Add Item" button. The entry is moved to the 2nd line of the bottom display. You should be in-balance: Debits = Credits and Difference = 0.

Click "Save & New".

*That completes the Debits and Credits for the first check*

For the next check, add the transactions (Debit and Credit) for the check you wrote for Office Rent.

Enter the Debit for the Office Rent check you wrote above.

Click "Add Item".

Now add the Credit to First Nat. Bank for the Office Rent check.

Change the GL Number to 11010 and the Credit/Debit to C, as above, then Click "Add Item" button.

Click "Save & Close" button.

Be sure you are In Balance each time you complete a transaction. The Debits should equal the Credits and the Difference should be zero.

*You have finished adding the Journal Entries for two Cash Disbursements - two sets of Debits and Credits*

NOTES ON FIELDS FOR TRANSACTION FILE:

CHECK NUMBER: Used to update the Bank file. We are pretending you wrote a hand written check and we would enter the number of that check.

DOCUMENT NUMBER: Used as a trace number for the check or invoice. Typically, for Cash Disbursements use the check number. Amount of check and check number will be updated to the Bank program.

TRANSACTION DATE: This date is used when specifying beginning and ending dates for Operating Statements, Financial reports, etc… Use the same transaction date for all entries, such as 12/30/2011.

SOURCE TYPE AND SOURCE NUMBER: Used to locate and print the source name when printing Operating Statements. The Vendor Number must exist in your Vendor file. Otherwise, this is only used to help you trace the source of the document. You can enter a blank (<enter>), if you don't use these fields. The source type is the type of file (V=Vendor File, O=Owner File,etc) and the source number is the number used in the associated file type (10000 = Acme Oilfield Services).

G/L NUMBER: The account number used for posting debit and credit entries to the General Ledger. The G/L number used must reside in your Company Chart of Accounts. For every credit entry, you must have a debit entry to keep the G/L in balance.

UNIT NUMBER: Normally the Well Number. If you don't enter a Unit number, the Transaction is not used when printing Operating Statements.

DOI STATUS LEVEL: Used here the same as for the Accounts Payable Invoice. The status indicates which percentage in the DOI file to use for each investor. The Status defaults to the status value stored in the Unit file, allowing you to depress the <enter> key to quickly accept the default value or you can change the status to be used. If NO Unit Number is entered the Status defaults to zero.

OIL/GAS PRODUCTION DATE: Only necessary when entering a run check for sales and taxes. Used to update monthly production volume for sales and taxes to Well Analysis Report. Production date for sales and tax G/L numbers will be reflected on revenue check stub if detailed is listed.

PRODUCTION TYPE AND PRODUCTION VOLUME: This is only necessary when entering a run check. Production type is used to trigger printing a volume on the Operating Statement and to update the Unit/Well file with production history volumes. Use O for oil or G for gas. Production volume will not be used if type is not O or G. This field is not used here when we entered the Cash Disbursement transaction because the disbursement is not a run check and therefore has no bearing on any production volume.

UNIT PRICE: Only necessary when entering a Run Check and it is the price per unit in MCF's or BBL's. Some states now require this to be printed on the Operating Statements.

DESCRIPTION: The Description defaults to the GL Description used in your Company Chart of Accounts. However, if you change the Description the new (extra) description will also be printed on Operating Statements. The description of the G/L account is always printed on Operating Statements. If you want more than the G/L description, enter it here, and both descriptions will be printed on Operating Statements.

AMOUNT: Enter the amount to be posted for this record. After entering the amount, click 'Save & Close' to save and finish the entry or 'Save & New' to save the entry and add another G/L Transaction.

Reports To Verify Entries

Transaction Listing - Should contain every debit and credit entered and total to zero.

Related Topics

Created with the Personal Edition of HelpNDoc: Easy EPub and documentation editor