A Run Check is a revenue check received from the sale of oil and/or gas. Journal Entries for Run Checks are entered through the Run Check Entry routine. It's the same process as entering normal journal entries but, the screen is specifically designed for Run Checks.

TUTORIAL SCENARIO

Normally you enter three transactions,

Credit the sales account (G/L number 30000 to 39999) for the gross amount of the check. See GL Number Restrictions.

Debit taxes (G/L number 50000 to 59999) for the amount of taxes

Debit the cash account (G/L number 10000 to 19999) for the net amount of the check (Gross - Taxes).

Lets pretend we have a Run Check that needs to be disbursed to the Investors. A Run Check should have a Unit/Well Number, a Gross Amount and a Tax Amount. Normally the taxes are referred to as Cost of Sales. Assume the Run Check is from Pride Pipeline for $8,800 on Well #1. It is for 500 barrels of Oil at Unit price $18.00 per barrel.

This is 500 BBL's of Oil at $18/bbl = $9,000

less $100 for State Tax Oil, and

less $100 for Severance Tax

leaving a Net Check of $8,800.

The Check was deposited in 1st Nat'l Bank (G/L # 11010).

Our Debits and Credits should be as follows.

Credit Oil Sales (G/L=31010) for $ 9,000 for the Gross Sales

Debit State Tax Oil (G/L=50015) for $ 100

Debit Severance Tax (G/L=50030) for $ 100

Debit Cash -1st Nat'l Bank (G/L=11010) for $ 8,800 for the Net Check Amount

With the above information for our "Tutorial" Run Check

ENTER A RUN CHECK

From the Quick Menu select Transactions - Run Checks Entry.

Note: The Enter Item Line always displays the Last item entered.

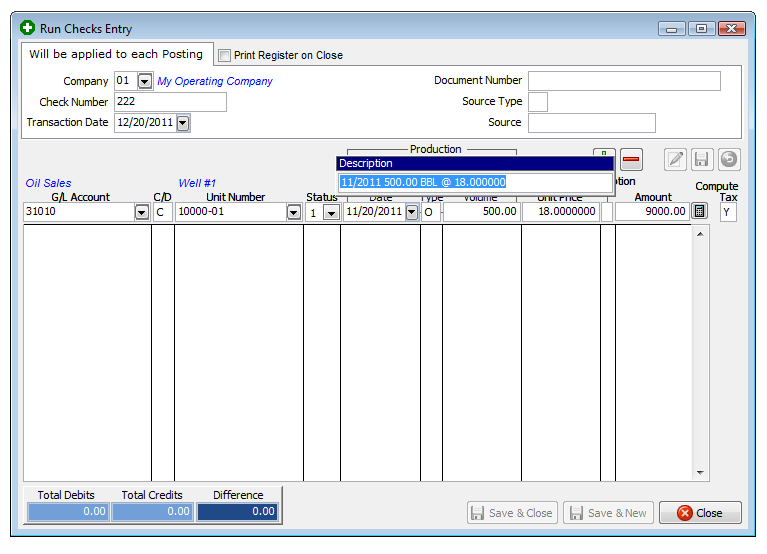

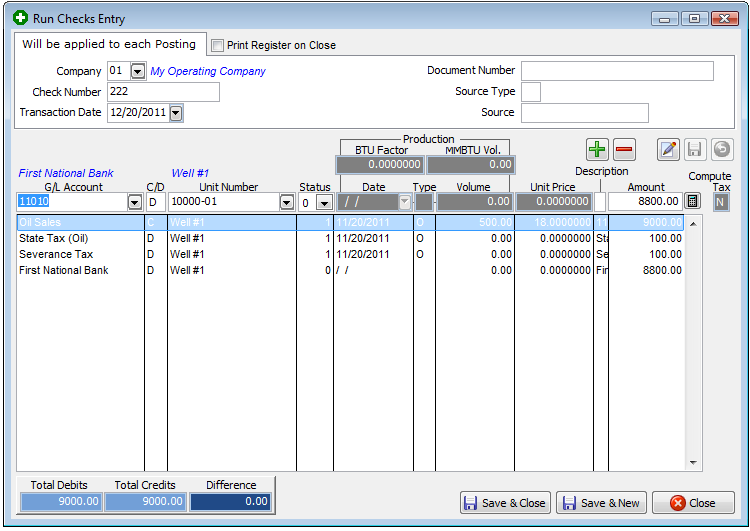

Make the following entries as shown in above image.

1st Entry - Credit Oil Sales (G/L=31010) for $ 9,000 for the Gross Sales. Click "Add Item" button (green plus sign).

2nd Entry- Debit State Tax Oil (G/L=50015) for $ 100. Click "Add Item" button.

3rd Entry - Debit Severance Tax (G/L=50030) for $ 100. Click "Add Item" button.

4th Entry - Debit Cash - 1st Nat'l Bank (G/L=11010) for $ 8,800 for the Net Check Amount. Click "Add Item" button.

Click "Save & Close"

*You are finished entering a Run Check*

Note: If the field for Compute Taxes is "Y", the following screen will pop-up to allow for a quick entry of taxes. For the Tutorial, we will assume you entered "N" for Compute Taxes, so we can better illustrate the debit and credit entry routine.

FYI: Only transactions with the following GL numbers are used when printing Operating Statements.

See GL Number Restrictions for more info.

30000 to 39999 sales accounts for disbursing revenue

50000 to 59999 cost of sales or taxes for disbursing revenue

71000 to 75999 billable expenses to Investors.

NOTES ON FIELDS FOR RUN CHECK ENTRY:

COMPANY NUMBER: The company this run check will be assigned to.

CHECK NUMBER: Normally the Purchasers check number.

TRANSACTION DATE: Used for beginning and ending dates on Operating Statements. You can use the calendar button to find a date for this transaction.

DOCUMENT NUMBER: Used as a trace number for this transaction or other reference information. (i.e. voucher number, P.O. number)

SOURCE TYPE: Source for this transaction (C = customer).

SOURCE NUMBER: Code number for above source type.

GENERAL LEDGER NUMBER: Code number of general ledger account to be debited or credited.

CREDIT/DEBIT: Enter 'C' for credit or 'D' for debit to general ledger number above. Credits are negative numbers and debits are positive numbers. Sales are usually credited and taxes are usually debited.

UNIT NUMBER: Normally the well number. If no well number is entered, the transaction is not used when printing Operating Statements. If no well number entered, the cursor will advance to the extra description field.

DOI STATUS LEVEL: Defaults to the status of the unit. Status may be changed for each transaction. Status determines which DOI owner percentages will be used.

OIL/GAS PRODUCTION DATE: This date will be printed as part of the description field for general ledger numbers 3xxxx and 5xxxx. Production date is used to update sales, taxes and volume to production month at period close. You can use the “calendar button” to find a production date for this transaction.

PRODUCTION TYPE: Must enter either 'O' for oil or 'G' for gas for oil/gas volume to show up on your Transaction by Unit report.

PRODUCTION VOLUME: If 'G' production type for gas is entered, you may enter MCF volume from run check. If 'O' production type for oil is entered, you may enter BBL volume. If you enter zero for no volume, gross sales will not be calculated.

BTU FACTOR: If 'G' production type is entered, you may enter BTU factor. MCF volume will be multiplied times BTU factor to compute MMBTU volume. If 'O' type entered, this field is skipped.

MMBTU VOLUME: MCF volume entered will be multiplied times BTU factor to arrive at MMBTU volume. You may enter MMBTU volume if you do not enter MCF volume or BTU factor. If 'O' type entered, this field will be skipped.

UNIT PRICE: Enter unit prices for MMBTU or BBL volume. If 'G' production type entered, MMBTU volume will be multiplied times unit price to compute gross gas sales. If 'O' production type, BBL volume multiplied times unit price will compute gross oil sales.

EXTRA DESCRIPTION: The description entered here is printed on the Operating Statements for the Investors. If 'G' production type, MCF volume entered is multiplied times BTU factor that equals MMBTU volume. MMBTU volume multiplied times unit price will be written to this field. If 'O' production type entered, BBL volume for oil will be multiplied times unit price and print in the description field. This field may be changed if you do not want the price to show on the Operating Statements to Investors.

AMOUNT: Computed by entering volume and unit price for either oil or gas. You may enter gross amount if not computed. You can use the calculator button to total the values.

COMPUTE TAX: If you say ‘Yes’ to compute tax values, the compute tax screen will be displayed. If you say ‘No’, you will be returned to the run check entry screen. If the general ledger number entered is not 3xxxx (sales account) this field will be skipped.

NOTES ON FIELDS FOR COMPUTE TAX:

TAX GENERAL LEDGER NUMBER: General ledger number must be in the range of 5xxxx-59xxx, taxes/deductions (tax /deducts that are deducted from revenue).

CREDIT/DEBIT: Enter 'C' for credit or 'D' for debit. Taxes are normally debited.

DOI STATUS LEVEL: The status indicates which percentage in the DOI file to use for each investor for tax general ledger number.

TAX RATE: Enter the tax factor for the tax general ledger number. A tax of 7 1/2% would be entered as .075.

TAX BASED ON (G/V/M): G=gross dollar value of sales, V=volume of MCF or BBL. M=MMBTU volume of gas. For gas sales enter either G/V/M. For oil sales enter 'G' for gross dollar oil sales or 'V' for volume of BBL (barrels) for tax to be computed.

EXTRA DESCRIPTION: The description entered here for tax general ledger number will be printed on the Operating Statements for Investors.

TAX AMOUNT: Gross tax will be computed based on the tax rate factor you enter multiplied by the tax based on (G/V/M) for gas or tax based on (G/V) for oil. You can use the calculator button to total any values you want without having to leave the program or use a 10 key.

SAVE: The computed gross tax will be displayed on the screen. If you save it, the tax amount will be posted to the Transaction file. If you cancel it the item is not posted. After posting the tax, you may add more taxes or exit to the Run Check Entry screen. Normally, you will select continue posting to another general ledger number such as cash for the net check amount. Balance condition of debits and credits are displayed on the screen. If you exit out of balance, you will be prompted your debits and credits do not equal. Use the Transaction file to edit or print the Transaction report for entries made in the Run Check Entry screen.

Reports To Verify Run Check Entries

Transaction Listing - Should contain every debit and credit entered and total to zero.

Related Topics

Accounting for Dummies ~ Oil and Gas for Dummies

Created with the Personal Edition of HelpNDoc: Easily create EPub books