FAQ about Setting Up Your Own Data

Do I have to make a new directory for each company I have?

No, one data directory can hold up to 99 companies. Everything is sorted under the company number you place it under. You can have separate data directories for each company if you want, but it is not necessary. The only advantage to having separate directories is when you Make a Backup of your data to the hard drive. Every time you make a temporary backup in Derek it overwrites the previous backup that was made. If you have separate directories you do not have to worry about backing up both companies to the same directory. You will have to have a separate backup directory for each of your data directories.

Why do I need to use General Ledger, if I only use Derek for JIB's and Revenue Distribution?

Both of those operations depend on the coding of GL numbers to determine what is revenue and what is an expense. You couldn’t disburse revenue and expenses and update Operating Statements without the General Ledger.

Can I use the Deduction Fields in the Employee File for PreTax Deductions?

No, the deductions in the employee file are deductions taken out after taxes every pay period. You will need to go to File, Setup Options, and then Payroll Features and put a check mark in the ‘Use Pretax Deduction’ field.

Can I use the same owner & vendor numbers for different companies?

Yes, you can have owner/vendor 10000 in company 01 and company 02. These two owner/vendor files will never touch each other. Their company number separates owners and vendors. You can even have a vendor and an owner within the same company with the same number. They will reside in two separate files, the owner file and the vendor file.

Can I use the same owner number for an owner who has a Royalty and Working interest?

No, the owner number must be different for the two different interests. The Working Interest owners have different minimum 1099 amounts than the Override and Royalty owners. They must be separated so their Government Form 1099’s are correct at the end of the year. Reference the IRS for additional information. Derek will not allow two of the same owner numbers on the same well.

What do I need to put as the Master Unit Number?

The master unit number is used only to group units together. This is mainly used for profit and loss statements and dividing an Account Payable invoice to all of the units under that Master. All units must have the same master unit number to be grouped together for this purpose. If you do not require this you may leave the field blank.

What are Oklahoma County Codes?

These are 2 or 3 digit codes that are required for each well that is in Oklahoma. The county codes help determine which county a well is in. You can get these from the OK tax commission.

Do I have to setup up 8 Division of Interest statuses for each owner on each unit?

You only have to set up one status for oil and one for gas if their percentages of ownership are different for each. If they have the same share of oil and gas you can use the same status for both. Choose the status/statuses you want to put your owner percentages on. Those status numbers must total to 100%. The other statuses can be used for other sales, different percentages and corrective entries.

What does Company Interest in the Division of Interest mean?

This is used to determine if this owner has any Company's interest in this Unit. Normally owner numbers from 99990 to 99999 are used for Company Interest. If this field is check marked, the Revenue, Tax and Expense interest for each transaction status is used to calculate the P&L Report for the Company Interest.

How can I check my DOI to make sure it equals 100%?

Go into the Division of Interest and click on the tab that says Filter. Put in your company number and the unit number you want to check. Leave the owner number, suspense and owner type boxes blank. Click on the Print or View button then select 'Bottom Line Totals Only' and in 'Unit Number Order'. This will print a report for that unit and total it at the bottom so you can see what the percentages add up to. If you want to check all units leave the unit number box blank on the filter page.

Can I change and add my own G/L numbers to the Company Chart of Accounts?

Yes, but there are some G/L numbers that need to remain in the Chart of Accounts. See GL Number Restrictions. Also, when it asks to change them in the Unit Chart of Accounts say yes. Any description can be changed.

What Transaction dates do I use when entering data?

The transaction date is the date you want to show something taking place in your books. Derek looks at transaction dates for almost everything it does. If you get a check today you enter the check with today’s transaction date if you want to show it hitting the books as of that day.

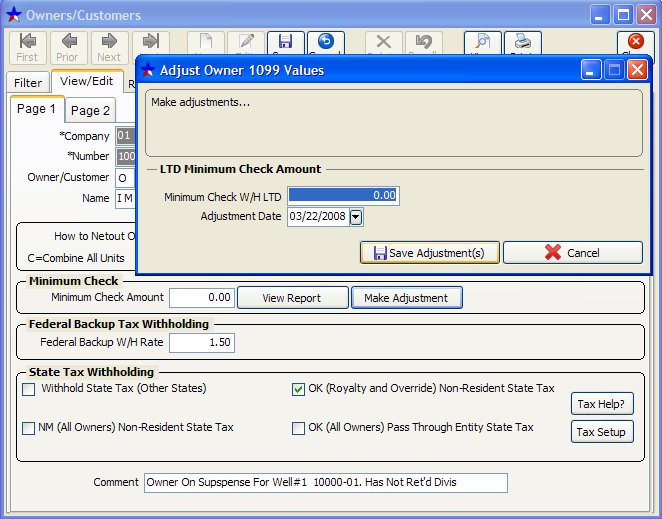

How do I setup prior suspense and minimum check withholding?

The Minimum check withhold revenue is put into the Minimum Check Withhold LTD box under the 'Make Adjustment' in the Owner/Customer file. Enter the dollar amount that you have withheld into this box. The next step is to Add Journal Entries. This is for the balances you have just entered (Ex: Debit 25300-Retained Earnings and Credit 21011-Min. Check Withheld). These journal entries will depend on what your CPA advises.

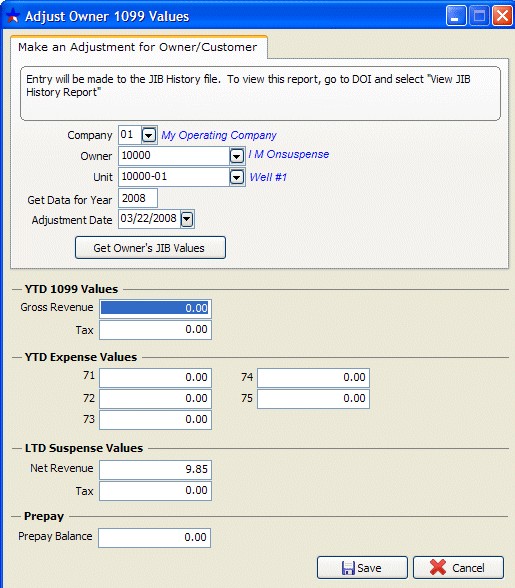

The Suspense Revenue balances are in the Division of Interest file. You will need to mark the box that says "Suspense" with a check mark and put in their Beginning Suspense Date. Put their suspense revenue and tax into the LTD boxes for Net Revenue and Tax. These boxes are located under the 'View/Adjust 1099 Values'. Again you will need to Add Journal Entries (Ex: Debit 25300-Retained Earnings and Credit 21010-Suspense Withheld). Check with your CPA for the exact journal entries required.

Related Topics

How to use Minimum Check Amount

How to use Prepay's (Advances)

Created with the Personal Edition of HelpNDoc: Free help authoring tool