Appendix ››

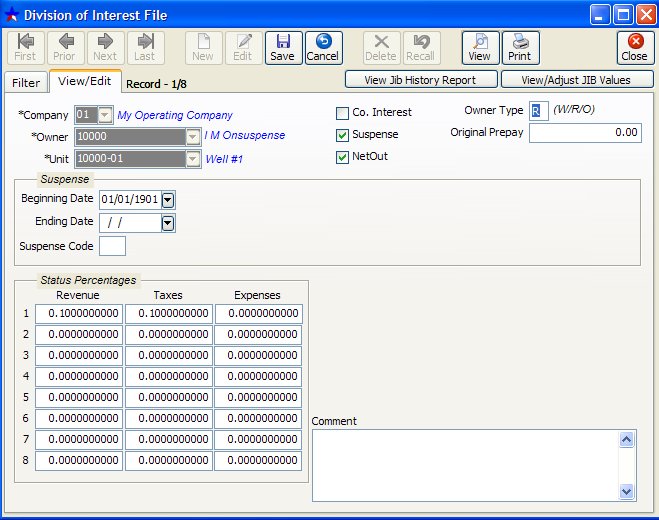

Placing an owner on suspense means that he is not to receive a revenue check for any amount as long as he is on suspense. Suspense amounts are stored in the Division of Interest file. Each time revenue statements and checks are printed, a suspense owner’s revenue amount is placed in the suspense fields of his Division of Interest record, and he does not receive a check. You must enter a beginning date for an owner on suspense.

Since the Operating Statements read from the DOI file to determine who is on suspense, the suspense action is performed on an owner by owner and unit by unit basis. This gives you a lot of flexibility in designating who is on suspense. For example, you can designate an owner to be on suspense on some units, but not on others.

NOTES ON FIELDS IN DOI FILE:

SUSPENSE: Specifies whether or not the owner is on suspense for this unit. If marked ‘Y’, revenue checks, from Operating Statements, are held in suspense and not issued to the owner until his suspense is change to ‘N’. An owner’s suspense status may be changed in the DOI file or in the JIB program on your tool bar under Tools for Statements. You may also refer to the Appendix section in Manual regarding Suspense.

SUSPENSE BEGIN: When an owner is placed on suspense, you must specify a beginning suspense date. The Non Released Suspense report can not be run without a beginning suspense date, since this date is used to gather the records from the Year to Date Transaction file.

SUSPENSE ENDING: When an owner is released from suspense the current months first transaction date less 1 day is plugged into this field. The date is used to print the Released Suspense report.

NET REVENUE LTD SUSPENSE VALUES: This is the gross amount of revenue minus (federal backup withhold amount and or state tax withhold amount if any) and the gross taxes, for life to date. These fields are updated during the Operating Statement update and are triggered from the field suspense in this same DOI file. When an owner is taken off suspense, these fields are cleared and the life to date net revenue in suspense plus the life to date tax in suspense is placed in the gross revenue released year to date. You should print the Non Released Suspense report from the JIB program on your tool bar under Other Reports and compare it to Trial Balance general ledger number 21010. These totals should always agree. If an owner has federal or state tax withheld, is in suspense or has minimum check amount, the federal or state tax withheld amount will be updated to gross revenue released year to date when Operating Statements are updated. Net suspense or minimum check amount is minus federal or state tax withheld. Federal and state tax amounts will be stored in the Owner/Customer file for Government Form 1099 printing.

TAX LTD SUSPENSE: These fields reflect an owner’s tax in suspense for the month, year to date and life to date. Just like the suspense revenue fields, these fields are updated during the update for Operating Statements, and are triggered from the suspense field. When an owner is taken off of suspense, these fields are cleared and the life to date amount is added to the tax released year to date field.

HOW DO YOU SET UP AN OWNER TO BE ON SUSPENSE?

To place an owner on suspense, you only need to change his suspense field in the DOI file to a ‘Y’ and enter a Beginning Date. A quick way is to use the Tool to Set Up Owners for Suspense. When Operating Statements are updated, all revenue will be stored in the suspense revenue fields in the DOI under 'View/Adjust JIB values'.

TO RELEASE AN OWNER FROM SUSPENSE

Change the suspense field back to ‘N’. Do not enter an ending suspense date, Derek will put one there when you update your Operating Statements. When Operating Statements are printed all revenue stored in the life to date suspense revenue fields will be released to the owner automatically. If there are no transactions for the unit, the Operating Statement will be printed reflecting suspense credit released. Be sure to print revenue checks and update for Operating Statements. A debit to 21010 suspense revenue and a credit to cash will be posted in the Transactions file and the DOI file will be updated when you update for Operating Statements.

As long as an owner is on suspense, the 1099 for the owner reflects zero in year to date revenue released and year to date taxes released. An owner can be held in suspense indefinitely and will not receive a 1099 until his SUSPENSE field is N and the year to date revenue released and year to date tax released is non-zero.

APPLY NON-RELEASED SUSPENSE AMOUNTS TO ACCOUNT RECEIVABLE INVOICES

If an Owner has amounts in Suspense Revenue, you can apply those amounts to money that he owes for AR Invoices.

Use the Tool to Apply Non-Released Suspense to Accounts Receivable.

SETTING UP SUSPENSE OWNERS, WHEN ENTERING BEGINNING DATA

If you are entering beginning data, (setting up your files for the first time) there are two steps for entering suspense owners. Use the Master routine for the Division of Interest file and enter his life to date net revenue suspense balance (gross minus taxes), and his life to date tax suspense balance in the DOI file under 'View/Adjust JIB values'. Secondly, Transactions file, Add routine and post a debit and credit in the Transactions file for the net suspense value.

Example of Setting Up the DOI file:

Gross revenue was $160.00, and taxes (cost of sales) were $20.00. His Net Suspense should be entered as $140.00 in the life to date field. His tax suspense should be entered as $20.00 in the life to date field. When his net suspense balance of $140.00 is released, the Derek will add 140 plus 20 to make year to date gross revenue $160.00 and $20.00 will be reflected in his year to date taxes.

Example of Setting Up the Transactions file:

Select the Transactions file and enter a debit and credit. Credit general ledger number 21010 (Suspense Revenue), and debit a Revenue Offset Account, such as general ledger number 76xxx (the sample data has this account as 76330) for the net amount of $140.00. Some operators prefer to debit their cash account instead of the revenue offset.

REPORTS FOR SUSPENSE

Released Suspense Revenue Report

Non-Released Suspense Revenue Report

The total for Non-Released Suspense Revenue Report should equal the amount for GL Number 21010 (Suspense Revenue) in the Trial Balance report.

Why doesn't the Released Suspense Revenue Report agree with what was Released for an Owner?

The Transaction file and the DOI files are used for this report. The beginning and ending suspense date is picked up from the DOI file. The transactions for the beginning and ending suspense dates in the DOI file are checked in the Transaction file to locate the unit number and status used for these dates. The program looks in the DOI file for the current percentage for the owner under that status to calculate the revenue and tax amount and list the detail. If percentages for the owner have changed for the status between the beginning and ending suspense dates the Released Suspense Revenue Detail report will not reflect the same values as the original Operating Statement. The current Transaction file is not used for this report.

Related Topics

Created with the Personal Edition of HelpNDoc: Free HTML Help documentation generator