Appendix ››

Netouts refer to subtracting expenses and prior Accounts Receivable balances from current Revenue being disbursed, when printing Operating Statements.

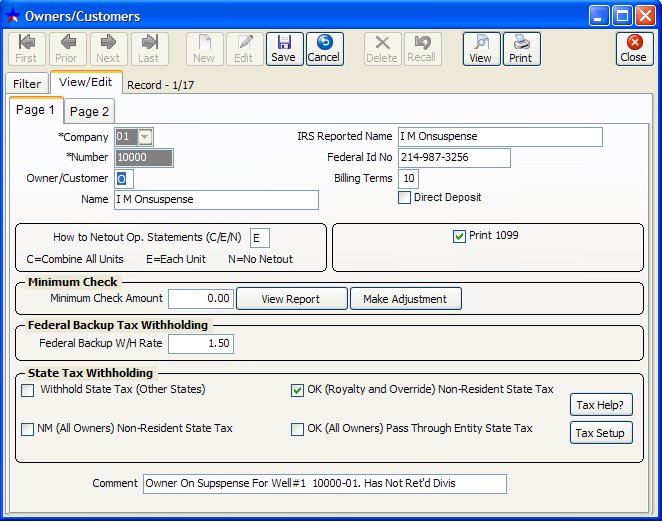

You must have your Netout codes entered in your Owner File.

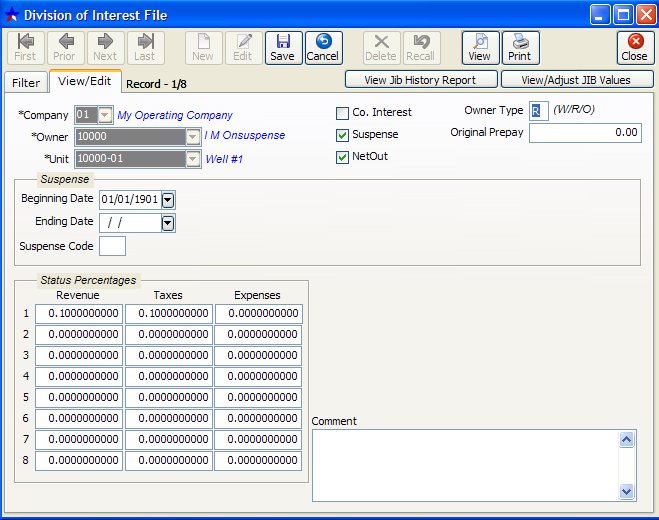

This code determines how to netout this owner when printing Operating Statements. If the netout code in the Owner/Customer file is E, only then will the DOI file be checked for netout.

C = Combine the amount owed on all units into one single balance forward due. Operating Statements will not check DOI file; the C here overrides the netout code in the DOI file.

E = Each unit has its own balance forward due. Operating Statements will check the DOI file, if netout code in DOI file is checked, then expenses and prior balance invoices for that unit will be subtracted from revenue on the unit. If Owner file is coded "E", then each Unit for this particular Owner must be coded in the DOI File.

N = No netout to be done for this owner. Operating Statements will not check DOI file; the N here overrides any netout code in the DOI file.

To enter the Netout codes in the Owner file you can either go to the Owner/Customer file and enter them individually, or you can use the Quick Tool to Enter NetOut Codes for several Owners at a time.

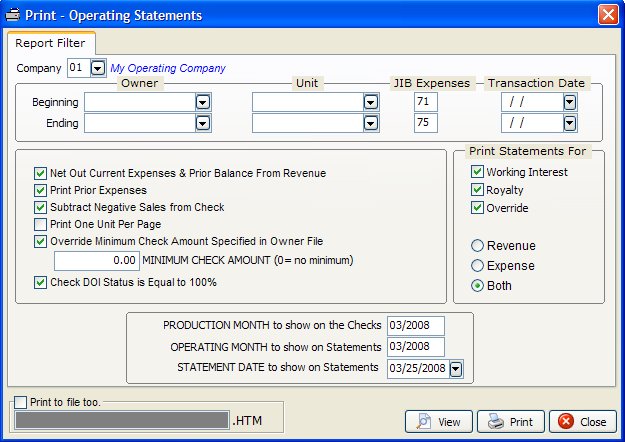

When printing Operating Statements you can Override the codes in the Owner and DOI file, by entering "N". However, you should nearly always enter "Y" and let the codes in the Owner and DOI files take effect.

OPERATING STATEMENTS & NETOUT

Netout is defined as subtracting the amount an owner owes you from the amount of his revenue check. Netout is the highest priority level of the other filters in the Operating Statement. You nearly always should enter "Y" and let the codes in the Owner and DOI file control this function.

If you enter ‘Y’ for netout and the owner is coded ‘E’ in the Owner/Customer file, then Derek looks in the DOI file to inspect each unit individually. If in the DOI file, the owner is coded ‘Y’ he is netted on that unit, otherwise he is not netted.

If you enter ‘Y’ for netout and the owner is coded ‘N’ in the Owner/Customer file, no netting will transpire for the owner.

Any prior balances due are listed automatically when you netout and reflected on the Operating Statements.

If you enter ‘N’ for netout, no netout will be saved regardless of the code in the Owner/Customer file.When you have current revenue and expenses, Owners will receive a check for revenue and owe you for expenses. Any prior balance due will reflect not netted.

During the update routine, Derek automatically post a payment toward his invoices - according to netout code in the Owner/Customer file and continuing for each owner.

Related Topics

Created with the Personal Edition of HelpNDoc: Easily create EPub books