JIB ›› Preliminary Reports for Operating Statements ››

This is printed prior to printing Operating Statements to help verify that all entries have been made to each unit for the period. It reads from the Transaction file and prints all transactions for the specified filter conditions that have a status other than 0 and have been assigned to a unit.

TUTORIAL SCENARIO

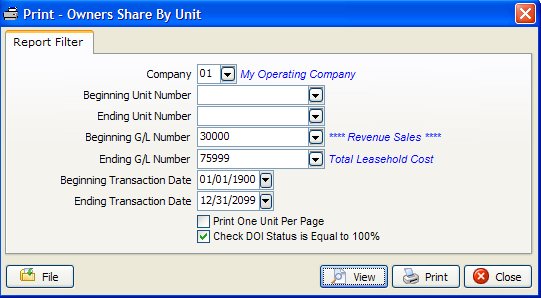

Print this report for Company Number 01 and all other values as shown in the image EXCEPT FOR DATES. Use dates that will apply to the dates you entered for your transactions. Refer to the Notes on Fields if you need more info.

PRINT OWNERS SHARE BY UNIT REPORT

From the Drop Down Menu, select JIB - Preliminary Reports - Owners Share by Unit.

You normally want to use the same filter conditions as used in Transactions by Unit Report.

This report is to verify each owners share of revenue, taxes and expenses for the period. This report provides the unit transaction total based on gross entries and the unit disbursement total based on each owners share. If the DOI file has been set up at 100% these two totals should agree. Disbursement total may vary by pennies from transaction total due to rounding when multiplying owners' interest. General ledger will not be out of balance. You should check this report carefully prior to running Operating Statements.

Each owners share of each transaction is calculated by using the owners percent in the DOI file that corresponds with the status of the transaction. For example, if the status of the transaction is two, then the percentage listed in EXP2 of the DOI file is multiplied by the transaction amount to determine the owner's share of expenses.

Royalty and Override owners do not print for expenses.

Transactions with a status of zero do not print.

Transactions not assigned to a unit do not print.

This report lists each owners share of revenue, taxes, expenses and any federal backup withhold or state tax withhold amount on each unit for all transactions per unit. It does not consider such things as balance forwards (for netouts), suspense, and minimum check amounts. It is normally printed with the same filters as the Transactions by Unit report above.

NOTES ON FIELDS

COMPANY NUMBER: Do one company at a time. You should print Preliminary Reports, Operating Statements, and Revenue Checks and Update Operating Statements for one company at a time.

UNIT NUMBER: Leave blank for beginning and ending unit numbers to have report print for all units.

G/L NUMBER: Only transactions in following ranges are used to print Operating Statements. See GL Number Restrictions

30000-39999 REVENUE /SALES

50000-59999 TAXES /DEDUCTIONS

71000-75999 BILLABLE EXPENSES TO OWNERS

Normally you should use 30000 for the Beginning GL Number and 75999 for the Ending. However, if you are getting tricky, you could for example:

To print only for Expenses, specify:

Beg. GL Number = 71000

End. GL Number = 75999

To print only for Revenue, specify:

Beg. GL Number = 30000

End. GL Number = 59999

BEGINNING AND ENDING TRANSACTION DATES: Normally this is the beginning and ending date of your period (or month). Only transactions within the specified range are processed for the report.

PRINT ONE UNIT PER PAGE: Normally unchecked, as this uses more paper.

CHECK DOI STATUS EQUALS 100%: This will verify that in the DOI file, each Unit has 100% ownership - that is normally desirable.

Created with the Personal Edition of HelpNDoc: What is a Help Authoring tool?